| Revision as of 04:30, 12 October 2014 view sourceWasill37 (talk | contribs)376 editsm citation error← Previous edit | Revision as of 22:42, 20 October 2014 view source Fleetham (talk | contribs)Extended confirmed users12,141 edits Introduce material from main Bitcoin pageNext edit → | ||

| Line 7: | Line 7: | ||

| Reasons that have been alleged for restricting or banning cryptocurrencies include their use for illegal trade and other illegal payments, protection of the national currency, and protection of the nation's financial system. Many ]s, even in countries that officially allow their use, have issued warnings to the public about their risks. | Reasons that have been alleged for restricting or banning cryptocurrencies include their use for illegal trade and other illegal payments, protection of the national currency, and protection of the nation's financial system. Many ]s, even in countries that officially allow their use, have issued warnings to the public about their risks. | ||

| ==International== | |||

| In July 2014 the ] advised European banks not to deal in virtual currencies such as bitcoin until a regulatory regime was in place.<ref name=EBA>{{cite web|title=EBA Opinion on ‘virtual currencies|url=http://www.eba.europa.eu/documents/10180/657547/EBA-Op-2014-08+Opinion+on+Virtual+Currencies.pdf|publisher=European Banking Authority|accessdate=8 July 2014|pages=46|format=pdf|date=4 July 2014}}</ref> | |||

| The 2013 ]'s ] published guidance for Internet-based payment services that defines "exchangers buying or selling digital currency for cash (or other digital currencies) as a virtual bureau de change" and warns that "Internet-based payment services that allow third party funding from anonymous sources may face an increased risk of " concluding that this may "pose challenges to countries in regulation and supervision".<ref name=fatf>{{cite web|url=http://www.fatf-gafi.org/media/fatf/documents/recommendations/Guidance-RBA-NPPS.pdf|title=Guidance for a Risk-Based Approach: Prepaid Cards, Mobile Payments and Internet-based Payment Services|work=Guidance for a risk-based approach|publisher=Financial Action Task Force (FATF)|accessdate=6 March 2014|location=Paris|page=47|format=PDF|date=June 2013}}</ref> | |||

| == List of legal status by country == | == List of legal status by country == | ||

| Line 24: | Line 29: | ||

| | {{flag|Belgium}} || {{yes}} || The government has decided to take a hands-off approach to the currency. Belgium's finance minister has publicly stated that he sees no problem with the currency and that the national bank would have no objections to it. The country's money laundering agency has also not released any guidelines or warnings against the currency.<ref name="Coinbase">{{cite web|url=http://www.coindesk.com/belgiums-finance-minister-has-no-objection-to-bitcoin/ |title=Belgium’s finance minister has no objection to bitcoin |publisher=Coinbase |date=11 September 2013 |accessdate=31 December 2013}}</ref> | | {{flag|Belgium}} || {{yes}} || The government has decided to take a hands-off approach to the currency. Belgium's finance minister has publicly stated that he sees no problem with the currency and that the national bank would have no objections to it. The country's money laundering agency has also not released any guidelines or warnings against the currency.<ref name="Coinbase">{{cite web|url=http://www.coindesk.com/belgiums-finance-minister-has-no-objection-to-bitcoin/ |title=Belgium’s finance minister has no objection to bitcoin |publisher=Coinbase |date=11 September 2013 |accessdate=31 December 2013}}</ref> | ||

| |- | |- | ||

| | {{flag|Bolivia}} || {{No}} || The Central Bank of Bolivia (BCB for short in Spanish ]) released a resolution stating that cryptocurrency is not allowed in Bolivia.<ref>{{cite web|title=Resolución 044/2014|url=http://www.bcb.gob.bo/webdocs/2014/Normativa/Resoluciones/044%202014.PDF|accessdate=2014-06-20|language=Español}}</ref> |

| {{flag|Bolivia}} || {{No}} || The Central Bank of Bolivia (BCB for short in Spanish ]) released a resolution stating that cryptocurrency is not allowed in Bolivia.<ref>{{cite web|title=Resolución 044/2014|url=http://www.bcb.gob.bo/webdocs/2014/Normativa/Resoluciones/044%202014.PDF|accessdate=2014-06-20|language=Español}}</ref> Bitcoin is banned by the Bolivian central bank.<ref>{{cite news|url=http://www.bloomberg.com/news/2014-07-10/bitcoin-by-bitcoin-the-winklevii-etf-inches-closer-to-reality.html|title=Bitcoin by Bitcoin, the Winklevii ETF Inches Closer to Reality|publisher=Bloomberg|date=10 July 2014|author=Eric Balchunas}}</ref> | ||

| |- | |- | ||

| | {{flag|Brazil}} || {{yes}} || The Brazilian tax authority followed in the Internal Revenue Service’s footsteps today in requiring bitcoin holders in Brazil to file capital gains on their tax returns. Like the IRS, Brazil is refraining from call it a currency, but instead requires people to file capital gains like any other security. The tax is good on holders of R$1,000 or more in bitcoin, which is around $450. Those who have over R$35,000 in bitcoin accounts pay a 15% capital gain charge as well to the Brazilian government. Gains (and losses) are to be filed annually with tax returns.<ref name="Forbes">{{cite web|url=http://www.forbes.com/sites/kenrapoza/2014/04/07/brazil-follows-irs-declares-bitcoin-gains-taxable/ |title=Brazil Follows IRS, Declares Bitcoin Gains Taxable |publisher=Forbes |date=7 April 2014 |accessdate=15 May 2014}}</ref> | | {{flag|Brazil}} || {{yes}} || The Brazilian tax authority followed in the Internal Revenue Service’s footsteps today in requiring bitcoin holders in Brazil to file capital gains on their tax returns. Like the IRS, Brazil is refraining from call it a currency, but instead requires people to file capital gains like any other security. The tax is good on holders of R$1,000 or more in bitcoin, which is around $450. Those who have over R$35,000 in bitcoin accounts pay a 15% capital gain charge as well to the Brazilian government. Gains (and losses) are to be filed annually with tax returns.<ref name="Forbes">{{cite web|url=http://www.forbes.com/sites/kenrapoza/2014/04/07/brazil-follows-irs-declares-bitcoin-gains-taxable/ |title=Brazil Follows IRS, Declares Bitcoin Gains Taxable |publisher=Forbes |date=7 April 2014 |accessdate=15 May 2014}}</ref> | ||

| Line 30: | Line 36: | ||

| | {{flag|Bulgaria}} || {{yes}} || On 2 April 2014, the issued a statement concerning the taxing of bitcoin. For the purpose of applying laws governing income taxes bitcoin is considered a financial instrument. The taxable income is determined by the sum of the profits from transactions with bitcoin decreased by the sum ot losses from transactions with bitcoin. The profit or loss from a transaction is calculated based on the comparison between the sale price and the aquistion price of bitcoin.<ref>{{cite web |title=Income form transactions with bitcoin should be decared and is taxable|url=http://www.nap.bg/news?id=1815|date=2 April 2014|publisher=National Revenue Agency|accessdate=2 April 2014}}</ref> | | {{flag|Bulgaria}} || {{yes}} || On 2 April 2014, the issued a statement concerning the taxing of bitcoin. For the purpose of applying laws governing income taxes bitcoin is considered a financial instrument. The taxable income is determined by the sum of the profits from transactions with bitcoin decreased by the sum ot losses from transactions with bitcoin. The profit or loss from a transaction is calculated based on the comparison between the sale price and the aquistion price of bitcoin.<ref>{{cite web |title=Income form transactions with bitcoin should be decared and is taxable|url=http://www.nap.bg/news?id=1815|date=2 April 2014|publisher=National Revenue Agency|accessdate=2 April 2014}}</ref> | ||

| |- | |- | ||

| | {{flag|Canada}} || {{yes}} || The Canadian government announced in February 2014 that it was going to regulate bitcoin under existing anti-money laundering and counter-terrorist financing legislation.<ref name="Canada to Regulate Bitcoin">{{cite web|last=Duhaime, Christine|title=Canada to Regulate Bitcoin, Digital Currencies and online casinos under its anti-money laundering and counter-terrorist financing laws|url=http://www.duhaimelaw.com/2014/02/11/canada-to-regulate-bitcoin-and-other-digital-currencies-under-its-anti-money-laundering-and-counter-terrorist-financing-laws/ |accessdate=7 March 2014|publisher=Duhaime Law}}</ref> In Quebec, ] stated in regards to bitcoin ATMs, that it would prosecute any violation of the Securities Act, the Derivatives Act, or the Money Services Business Act.<ref name="Canadian Official">{{cite web |last=Duhaime, Christine|title=1st Canadian official regulatory response to Bitcoin highlights Ponzi scheme and money laundering risks |url=http://www.duhaimelaw.com/2014/02/05/1st-canadian-official-regulatory-response-to-bitcoin-highlights-ponzi-scheme-and-money-laundering-risks/|accessdate=7 March 2014|publisher=Duhaime Law}}</ref> | |||

| ⚫ | |||

| ⚫ | On 5 November 2013, the ] issued a statement<ref>{{cite web | url=http://news.gc.ca/web/article-en.do?nid=787789 | title=What you should know about digital currency | accessdate=29 January 2014}}</ref> clarifying the tax treatment of Bitcoin. The statement is a brief outline which states that tax rules apply when Bitcoin is used to pay for goods and services in the same way the rules apply for barter transactions.<ref>{{cite news|title=Revenue Canada says BitCoins aren't tax exempt|url=http://www.cbc.ca/news/business/revenue-canada-says-bitcoins-aren-t-tax-exempt-1.1395075|accessdate=21 December 2013}}</ref> | ||

| In Canada, the federal government announced that it was going to regulate Bitcoin under its anti-money laundering and counter-terrorist financing legislation, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.<ref name="Canada to Regulate Bitcoin">{{cite web |last=Duhaime |first=Christine |title=Canada to Regulate Bitcoin, Digital Currencies and online casinos under its anti-money laundering and counter-terrorist financing laws|url=http://www.duhaimelaw.com/2014/02/11/canada-to-regulate-bitcoin-and-other-digital-currencies-under-its-anti-money-laundering-and-counter-terrorist-financing-laws/ |accessdate=7 March 2014}} Duhaime Law</ref> The Quebec government agency, the Autorité des marches financiers, also announced that it would prosecute violations of the Securities Act (Loi sur les valeurs mobilières), the Derivatives Act (Loi sur les instruments dérivés) and the Money Services Businesses Act (Loi sur les enterprises de services monétaires) for Bitcoin transactions, particularly those involving Bitcoin ATMs.<ref name="Canadian official">{{cite web |last=Duhaime |first=Christine |title=1st Canadian official regulatory response to Bitcoin highlights Ponzi scheme and money laundering risks|url=http://www.duhaimelaw.com/2014/02/05/1st-canadian-official-regulatory-response-to-bitcoin-highlights-ponzi-scheme-and-money-laundering-risks/|accessdate=7 March 2014}} Duhaime Law</ref> | In Canada, the federal government announced that it was going to regulate Bitcoin under its anti-money laundering and counter-terrorist financing legislation, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.<ref name="Canada to Regulate Bitcoin">{{cite web |last=Duhaime |first=Christine |title=Canada to Regulate Bitcoin, Digital Currencies and online casinos under its anti-money laundering and counter-terrorist financing laws|url=http://www.duhaimelaw.com/2014/02/11/canada-to-regulate-bitcoin-and-other-digital-currencies-under-its-anti-money-laundering-and-counter-terrorist-financing-laws/ |accessdate=7 March 2014}} Duhaime Law</ref> The Quebec government agency, the Autorité des marches financiers, also announced that it would prosecute violations of the Securities Act (Loi sur les valeurs mobilières), the Derivatives Act (Loi sur les instruments dérivés) and the Money Services Businesses Act (Loi sur les enterprises de services monétaires) for Bitcoin transactions, particularly those involving Bitcoin ATMs.<ref name="Canadian official">{{cite web |last=Duhaime |first=Christine |title=1st Canadian official regulatory response to Bitcoin highlights Ponzi scheme and money laundering risks|url=http://www.duhaimelaw.com/2014/02/05/1st-canadian-official-regulatory-response-to-bitcoin-highlights-ponzi-scheme-and-money-laundering-risks/|accessdate=7 March 2014}} Duhaime Law</ref> | ||

| Line 36: | Line 44: | ||

| | {{flag|China}} (PRC) | | {{flag|China}} (PRC) | ||

| | {{partial|Restricted}}<br /><small>(])</small> | | {{partial|Restricted}}<br /><small>(])</small> | ||

| | China restricted bitcoin exchange for local currency in December 2013.<ref name="ccontrols">{{cite news | url=http://www.bbc.co.uk/news/technology-25428866 | title=Bitcoin sinks after China restricts yuan exchanges | publisher=BBC | work=bbc.com | date=18 December 2013 | accessdate=20 December 2013 | author=Kelion, Leo}}</ref> On 10 April 2014, the People’s Bank of China ordered banks and all third-party payment services to stop dealing with anyone in the bitcoin business. The ruling de-funds all Chinese bitcoin trading websites, as they will no longer have bank accounts in China.<ref>{{cite web|url=http://www.techinasia.com/china-banks-must-close-bitcoin-trading-bank-accounts/|publisher=TechInAsia|accessdate=9 May 2014|title=China’s banks give deadline for bitcoin exchanges to close their trading accounts| date=10 April 2014|quote= China’s bitcoin exchanges are being issued with formal notices stating that their bank accounts must be closed by April 15. China’s BTC Trade exchange announced today that it has been contacted by its bank and told to remove all funds prior to the deadline or else the assets will be frozen.}}</ref> | |||

| ⚫ | |||

| ⚫ | On 5 December 2013, ] barred financial institutions from handling Bitcoin transactions, moving to regulate the virtual currency. The ] said financial institutions and payment companies can’t give pricing in Bitcoin, buy and sell the virtual currency or insure Bitcoin-linked products, according to a statement on the central bank’s website.<ref name="Bloomberd">{{cite web|url=http://www.bloomberg.com/news/2013-12-05/china-s-pboc-bans-financial-companies-from-bitcoin-transactions.html |title=China Bans Financial Companies From Bitcoin Transactions |publisher=Bloomberg |date=5 December 2013 |accessdate=16 December 2013}}</ref> On 16 December it was speculated that the People's Bank of China had issued a new ban on third-party payment processors from doing business with Bitcoin exchanges,<ref name="BusinessInsider">{{cite web|url=http://www.businessinsider.com/china-bitcoin-crackdown-intensifies-2013-12 |title=Bitcoin's Outlook In China Is Not Looking So Good Right Now |publisher=Business Insider |date=16 December 2013 |accessdate=16 December 2013}}</ref> however a statement from BTC China suggests this isn't accurate, and rather payment processors had voluntarily withdrawn their services.<ref>{{cite web|url=http://allthingsd.com/20131219/china-bitcoin-exchange-ceo-were-not-giving-up-yet/ | ||

| |title=China Bitcoin Exchange CEO: We’re Not Giving Up Yet |date=19 December 2013 |accessdate=19 December 2013}}</ref> Trading bitcoins by individuals is however legal in China.<ref>http://www.bbc.co.uk/news/technology-25428866</ref> | |title=China Bitcoin Exchange CEO: We’re Not Giving Up Yet |date=19 December 2013 |accessdate=19 December 2013}}</ref> Trading bitcoins by individuals is however legal in China.<ref>http://www.bbc.co.uk/news/technology-25428866</ref> | ||

| |- | |- | ||

| | {{flag|Hong Kong}} SAR | | {{flag|Hong Kong}} SAR | ||

| | {{yes}} | | {{yes}} | ||

| | Pre-existing Hong Kong law covers acts of fraud and money laundering involving virtual commodities.<ref>{{cite news|last=Vallikappen|first=Sanat|title=Singapore to Regulate Bitcoin Operators for Laundering Risk|url=http://www.bloomberg.com/news/2014-03-13/singapore-to-regulate-bitcoin-operators-for-money-laundering.html|accessdate=23 March 2014|newspaper=Bloomberg|date=13 March 2014}}</ref> | |||

| ⚫ | |||

| ⚫ | On 16 November 2013, ], the chief executive of ] (HKMA) said that bitcoins is only a virtual commodity. He also decided that bitcoins will not be regulated by HKMA. However, the authority will be closely watching the usage of bitcoins locally and its development overseas.<ref>{{cite news |title=比特币不受金管局监管 (Bitcoin is not regulated by HKMA)|url=http://news.takungpao.com/paper/q/2013/1116/2042791.html|date=16 November 2013 |last= |first=|publisher=] |accessdate=18 January 2014}}</ref> | ||

| |- | |- | ||

| | {{flag|Taiwan|name=Taiwan}} || {{partial|Restricted}} || On 21 November 2013, ], the governor of ] (CBC) said that the central bank view bitcoins similar to precious metals transactions and has adopted measures to prevent money laundering in bitcoins.<ref>{{cite news |title=ROC Central Bank chief issues fresh warning on interest rate increases|url=http://www.chinapost.com.tw/taiwan-business/2013/11/21/394123/ROC-Central.htm|date=21 November 2013 |last=Chiu|first=Kathryn|publisher=] |accessdate=18 January 2014}}</ref> | | {{flag|Taiwan|name=Taiwan}} || {{partial|Restricted}} || On 21 November 2013, ], the governor of ] (CBC) said that the central bank view bitcoins similar to precious metals transactions and has adopted measures to prevent money laundering in bitcoins.<ref>{{cite news |title=ROC Central Bank chief issues fresh warning on interest rate increases|url=http://www.chinapost.com.tw/taiwan-business/2013/11/21/394123/ROC-Central.htm|date=21 November 2013 |last=Chiu|first=Kathryn|publisher=] |accessdate=18 January 2014}}</ref> | ||

| Line 55: | Line 67: | ||

| | {{flag|Denmark}} || {{yes}} || On 17 December 2013, Denmark's Financial Supervisory Authority (FSA) has issued a statement that echoes EBA's warning. In addition, FSA says that doing business with Bitcoin does not fall under its regulatory authority and therefore FSA does not currently prevent anyone from opening such businesses.<ref>{{cite web|last=Caffyn|first=Grace|title=Denmark’s Authorities: Bitcoin is Not Regulated Here|url=http://www.coindesk.com/denmarks-bitcoin-is-not-regulated-here/ |publisher=Coindesk|accessdate=24 December 2013}}</ref><ref>{{cite web |url=http://www.finanstilsynet.dk/da/Nyhedscenter/Pressemeddelelser/2013/Advarsel-mod-virtuelle-valutaer-bitcom-mfl-2013.aspx |title=Advarsel mod virtuelle valutaer |trans_title=Warning against virtual currencies |publisher=Financial Supervisory Authority |date=December 17, 2013 |language=Danish |archiveurl=https://web.archive.org/web/20131217113641/http://www.finanstilsynet.dk/da/Nyhedscenter/Pressemeddelelser/2013/Advarsel-mod-virtuelle-valutaer-bitcom-mfl-2013.aspx |archivedate=December 17, 2013}}</ref> FSA's chief legal adviser says that Denmark might consider amending existing financial legislation to cover virtual currencies.<ref>{{cite web|last=Schwartzkopff|first=Frances|title=Bitcoins Spark Regulatory Crackdown as Denmark Drafts Rules|url=http://www.businessweek.com/news/2013-12-17/bitcoin-rules-drafted-in-denmark-as-regulator-warns-against-use|accessdate=24 December 2013}}</ref> In March 2014, the Danish Tax Board, the nation's top tax authority, declared that personal profits and losses from Bitcoin trading would not be taxed, although Bitcoin trading businesses would be taxed.<ref>{{cite web|last=Sharkey|first=Tom|title=Denmark Declares Bitcoin Trades are Tax-Free|url=http://www.coindesk.com/denmark-declares-bitcoin-trades-tax-free/|publisher=Coindesk|accessdate=26 March 2014}}</ref> | | {{flag|Denmark}} || {{yes}} || On 17 December 2013, Denmark's Financial Supervisory Authority (FSA) has issued a statement that echoes EBA's warning. In addition, FSA says that doing business with Bitcoin does not fall under its regulatory authority and therefore FSA does not currently prevent anyone from opening such businesses.<ref>{{cite web|last=Caffyn|first=Grace|title=Denmark’s Authorities: Bitcoin is Not Regulated Here|url=http://www.coindesk.com/denmarks-bitcoin-is-not-regulated-here/ |publisher=Coindesk|accessdate=24 December 2013}}</ref><ref>{{cite web |url=http://www.finanstilsynet.dk/da/Nyhedscenter/Pressemeddelelser/2013/Advarsel-mod-virtuelle-valutaer-bitcom-mfl-2013.aspx |title=Advarsel mod virtuelle valutaer |trans_title=Warning against virtual currencies |publisher=Financial Supervisory Authority |date=December 17, 2013 |language=Danish |archiveurl=https://web.archive.org/web/20131217113641/http://www.finanstilsynet.dk/da/Nyhedscenter/Pressemeddelelser/2013/Advarsel-mod-virtuelle-valutaer-bitcom-mfl-2013.aspx |archivedate=December 17, 2013}}</ref> FSA's chief legal adviser says that Denmark might consider amending existing financial legislation to cover virtual currencies.<ref>{{cite web|last=Schwartzkopff|first=Frances|title=Bitcoins Spark Regulatory Crackdown as Denmark Drafts Rules|url=http://www.businessweek.com/news/2013-12-17/bitcoin-rules-drafted-in-denmark-as-regulator-warns-against-use|accessdate=24 December 2013}}</ref> In March 2014, the Danish Tax Board, the nation's top tax authority, declared that personal profits and losses from Bitcoin trading would not be taxed, although Bitcoin trading businesses would be taxed.<ref>{{cite web|last=Sharkey|first=Tom|title=Denmark Declares Bitcoin Trades are Tax-Free|url=http://www.coindesk.com/denmark-declares-bitcoin-trades-tax-free/|publisher=Coindesk|accessdate=26 March 2014}}</ref> | ||

| |- | |- | ||

| | {{flag|Ecuador}} || {{no}} || On 24 July 2014, Ecuador effectively banned bitcoin, along with all other decentralized digital currencies, approving a monetary reform allowing the government to create its own centralized digital currency. This new reform comes as a severe blow to the bitcoin industry in Ecuador, since it demands that they shut down their operations immediately. Those who defy the ban will face prosecution, and all bitcoins circulated and assets in bitcoin trades face confiscation.<ref>{{cite web|title=Ecuador Bans Bitcoin, Initiates Government-Run Digital Currency|url=http://panampost.com/panam-staff/2014/07/25/ecuador-bans-bitcoin-initiates-government-run-digital-currency/|publisher=Pan Am Post|date=25 July 2014}}</ref> | |||

| | {{flag|Ecuador}} || {{no}} || The National Assembly of Ecuador banned bitcoins including other decentralized digital/crypto currencies. Due to the establishment of a new, state-run currency.<ref>, coindesk.com</ref> | |||

| |- | |- | ||

| | {{flag|Finland}} || {{yes}} || ] issued a regulatory guide to Bitcoin in September 2013, which imposed capital gains tax on bitcoins, and taxes bitcoins produced by mining as earned income.<ref name="coindesk">{{cite web|url=http://www.coindesk.com/information/is-bitcoin-legal/ |title=Is Bitcoin Legal |date=26 November 2013 |accessdate=18 December 2013}}</ref> | | {{flag|Finland}} || {{yes}} || ] issued a regulatory guide to Bitcoin in September 2013, which imposed capital gains tax on bitcoins, and taxes bitcoins produced by mining as earned income.<ref name="coindesk">{{cite web|url=http://www.coindesk.com/information/is-bitcoin-legal/ |title=Is Bitcoin Legal |date=26 November 2013 |accessdate=18 December 2013}}</ref> | ||

| Line 63: | Line 75: | ||

| | {{flag|Iceland}} || {{no}}{{dubious|date=March 2014}} || Due to the capital controls put in place in 2008 to stop money flight on the króna, buying and selling Bitcoin in ], which appears to consider Bitcoin as a foreign currency, is Illegal.{{citation needed|reason=Only cited source says ''foreign exchange'' involving Bitcoin is illegal.|date=March 2014}} The Icelandic Central Bank confirmed that "it is prohibited to engage in foreign exchange trading with the electronic currency Bitcoin, according to the Icelandic Foreign Exchange Act",<ref name="mbl.is">{{cite news |title=Höftin stöðva viðskipti með Bitcoin |work=mbl.is|publisher=Morgunblaðsins|language=Icelandic| date=19 December 2013 |accessdate=19 December 2013 |url=http://www.mbl.is/vidskipti/frettir/2013/12/19/hoftin_stodva_vidskipti_med_bitcoin/}}</ref> however commentators suggest bitcoins mined within Iceland could be freely traded.{{citation needed|reason=The credentials of the commentators is important (e.g., legal scholars vs. television newscasters), and all claims like this need to be verifiable.|date=March 2014}} | | {{flag|Iceland}} || {{no}}{{dubious|date=March 2014}} || Due to the capital controls put in place in 2008 to stop money flight on the króna, buying and selling Bitcoin in ], which appears to consider Bitcoin as a foreign currency, is Illegal.{{citation needed|reason=Only cited source says ''foreign exchange'' involving Bitcoin is illegal.|date=March 2014}} The Icelandic Central Bank confirmed that "it is prohibited to engage in foreign exchange trading with the electronic currency Bitcoin, according to the Icelandic Foreign Exchange Act",<ref name="mbl.is">{{cite news |title=Höftin stöðva viðskipti með Bitcoin |work=mbl.is|publisher=Morgunblaðsins|language=Icelandic| date=19 December 2013 |accessdate=19 December 2013 |url=http://www.mbl.is/vidskipti/frettir/2013/12/19/hoftin_stodva_vidskipti_med_bitcoin/}}</ref> however commentators suggest bitcoins mined within Iceland could be freely traded.{{citation needed|reason=The credentials of the commentators is important (e.g., legal scholars vs. television newscasters), and all claims like this need to be verifiable.|date=March 2014}} | ||

| |- | |- | ||

| | {{flag|India}} || {{partial|Restricted}} || Digital or virtual currencies such as bitcoin have gained widespread acceptance in India despite a natural skepticism to assets not backed by tangible entities such as land. After the ] warning in December 2013, a number of bitcoin operators shut shop.{{citation needed|date=June 2014}} | |||

| ⚫ | |||

| The actions of the ED (enforcement directorate) and the I-T (income-tax) department have sent tremors throughout the mainstream bitcoin community in India, if only for the reason that there is still no official regulation on how companies involved in dealing with digital currencies should comply with anti-money laundering and financial transaction laws. | |||

| In short, the legality of Bitcoin is in doubt in India.<ref name=" http://ptlb.in/ccici/?p=336">{{cite news|url= http://ptlb.in/ccici/?p=336|title= The Legality Of Bitcoins In India|work= Exclusive Techno Legal Centre Of Excellence For Cyber Crimes Investigation In India |date=22 December 2013 |accessdate=27 August 2014}}</ref><ref name=" http://ptlb.in/iips/?p=317">{{cite news|url= http://ptlb.in/iips/?p=317|title= Bitcoins, Their Functionality And Legality Of Use | |||

| |work= Global ICT Policies And Strategies And Indian Perspective |date=26 November 2013 |accessdate=27 August 2014}}</ref> The Reserve Bank of India has cautioned users of virtual currencies of various legal risks.<ref name="RBIcautions">{{cite news|url= http://ptlb.in/iips/?p=392|title= RBI Cautions Users Of Virtual Currencies Against Risks|work= Global ICT Policies And Strategies And Indian Perspective |date=24 December 2013 |accessdate=27 August 2014}}</ref> Indian law enforcement agency ] also searched the office and website of a Bitcoin entrepreneur to analyse any possible legal violation.<ref name="EDsearched">{{cite news|url= http://ptlb.in/ccici/?p=340|title= Enforcement Directorate (ED) Searched Seven Digital Cash LLP Office And Website For Selling And Buying Bitcoins In India|work= Exclusive Techno Legal Centre Of Excellence For Cyber Crimes Investigation In India |date=27 December 2013 |accessdate=27 August 2014}}</ref> ED believes that Bitcoins money can be used for hawala transactions and funding terror operations.<ref name="Hawala">{{cite news|url= http://ptlb.in/ccici/?p=351|title= Bitcoins Money Can Be Used For Hawala Transactions And Funding Terror Operations: Enforcement Directorate|work= Exclusive Techno Legal Centre Of Excellence For Cyber Crimes Investigation In India |date=29 December 2013 |accessdate=27 August 2014}}</ref> | |||

| ⚫ | In June 2013, the ] (RBI) issued a notice acknowledging that virtual currencies posed legal, regulatory and operational challenges.<ref>{{cite web |url=http://timesofindia.indiatimes.com/business/india-business/RBI-red-flags-virtual-currency/articleshow/20808495.cms |title=RBI red flags 'virtual currency' |publisher=] |date=June 28, 2013 |accessdate=September 15, 2014}}</ref> In August 2013, a spokesperson wrote in an email that Bitcoin was under observation.<ref name=watch_India>{{cite news|title=Reserve Bank of India won't regulate virtual currency Bitcoin, yet|url=http://articles.economictimes.indiatimes.com/2013-08-14/news/41409715_1_bitcoin-gox-virtual-currency|accessdate=29 December 2013|newspaper=]|date=14 August 2013}}</ref> | ||

| On 24 December 2013, the Reserve Bank of India issued an advisory to the Indian public not to indulge in buying or selling of virtual currencies, including Bitcoins.<ref>{{cite web |url=http://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=30247 |title=RBI cautions users of Virtual Currencies against Risks |publisher=Reserve Bank of India |date=December 24, 2013 |accessdate=September 15, 2014}}</ref><ref name=RBI_adv>{{cite news|title=Reserve Bank warns against Bitcoin use|url=http://www.thehindu.com/business/Economy/reserve-bank-warns-against-bitcoin-use/article5497653.ece|accessdate=29 December 2013|newspaper=]|date=24 December 2013}}</ref> Following the announcement Bitcoin operators in the country began suspending operations.<ref name=shut_india>{{cite news|title=Bitcoin operators shut shop in India amid RBI warning|url=http://articles.economictimes.indiatimes.com/2013-12-27/news/45626977_1_bitcoin-other-virtual-currencies-potential-money-laundering-risks|accessdate=29 December 2013|newspaper=]|date=27 December 2013}}</ref> | On 24 December 2013, the Reserve Bank of India issued an advisory to the Indian public not to indulge in buying or selling of virtual currencies, including Bitcoins.<ref>{{cite web |url=http://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=30247 |title=RBI cautions users of Virtual Currencies against Risks |publisher=Reserve Bank of India |date=December 24, 2013 |accessdate=September 15, 2014}}</ref><ref name=RBI_adv>{{cite news|title=Reserve Bank warns against Bitcoin use|url=http://www.thehindu.com/business/Economy/reserve-bank-warns-against-bitcoin-use/article5497653.ece|accessdate=29 December 2013|newspaper=]|date=24 December 2013}}</ref> Following the announcement Bitcoin operators in the country began suspending operations.<ref name=shut_india>{{cite news|title=Bitcoin operators shut shop in India amid RBI warning|url=http://articles.economictimes.indiatimes.com/2013-12-27/news/45626977_1_bitcoin-other-virtual-currencies-potential-money-laundering-risks|accessdate=29 December 2013|newspaper=]|date=27 December 2013}}</ref> | ||

| Line 75: | Line 93: | ||

| |work= Exclusive Techno Legal Centre Of Excellence For Cyber Crimes Investigation In India |date=27 December 2013 |accessdate=27 August 2014}}</ref> ED believes that Bitcoins money can be used for hawala transactions and funding terror operations.<ref name=" http://ptlb.in/ccici/?p=351">{{cite news|url= http://ptlb.in/ccici/?p=351|title= Bitcoins Money Can Be Used For Hawala Transactions And Funding Terror Operations: Enforcement Directorate|work= Exclusive Techno Legal Centre Of Excellence For Cyber Crimes Investigation In India |date=29 December 2013 |accessdate=27 August 2014}}</ref> | |work= Exclusive Techno Legal Centre Of Excellence For Cyber Crimes Investigation In India |date=27 December 2013 |accessdate=27 August 2014}}</ref> ED believes that Bitcoins money can be used for hawala transactions and funding terror operations.<ref name=" http://ptlb.in/ccici/?p=351">{{cite news|url= http://ptlb.in/ccici/?p=351|title= Bitcoins Money Can Be Used For Hawala Transactions And Funding Terror Operations: Enforcement Directorate|work= Exclusive Techno Legal Centre Of Excellence For Cyber Crimes Investigation In India |date=29 December 2013 |accessdate=27 August 2014}}</ref> | ||

| |- | |- | ||

| | {{flag|Indonesia}} || {{partial|Restricted}} || |

| {{flag|Indonesia}} || {{partial|Restricted}} || A spokesman for Bank Indonesia reportedly issued a statement on bitcoin in December 2013, saying that "bitcoin is a potential payment method, but it’s different than ordinary currency... It is not regulated by the central bank so there are risks... At the moment, we’re studying bitcoin and we have no plan to issue a regulation on it."<ref name="btcregs">{{cite web | url=http://www.loc.gov/law/help/bitcoin-survey/regulation-of-bitcoin.pdf| title=Regulation of Bitcoin in Selected Jurisdictions | publisher=The Law Library of Congress, Global Legal Research Center | date=January 2014 | accessdate=26 August 2014}}</ref><ref>{{cite web | title=Bitcoin Finds Itty-Bitty Market in Indonesia | url=http://www.thejakartaglobe.com/business/bitcoin-finds-itty-bitty-market-in-indonesia/ | date=21 December 2013 | accessdate=29 September 2014 | publisher=Jakarta Globe}}</ref> | ||

| On 21 December 2013, Difi Ahmad, the executive director of communication at ] (BI) said that Bitcoin is a potential payment method but could potentially used in scams and money laundering operations. Since it is not regulated by banks, it has its associated risks. The central bank of Indonesia is currently studying Bitcoins and they have no plans to issue regulations on it.<ref>{{cite news |title=Bitcoin Finds Itty-Bitty Market in Indonesia |url=http://www.thejakartaglobe.com/business/bitcoin-finds-itty-bitty-market-in-indonesia/|date=21 December 2013 |last=Baskoro |first=FM|publisher=] |accessdate=18 January 2014}}</ref> | |||

| ⚫ | On 16 January 2014, Ronald Waas, deputy governor of ] said that bitcoins usage would break a number of laws including ''Undang-undang Bank Indonesia'' (Bank Indonesia Act), ''Undang-undang Informasi dan Transaksi Elektronik'' (Information and Electronic Transaction Act), and ''Undang-undang Mata Uang'' (Monetary Act). For example, ''Undang-undang Mata Uang'' states that ] is the only legal tender in the country. He also strongly advised the public against using bitcoins because security of bitcoins transactions are not guaranteed. However, currently BI does not have detailed policies of regulating or banning bitcoins usage. |

||

| ⚫ | On 16 January 2014, Ronald Waas, deputy governor of ] said that bitcoins usage would break a number of laws including ''Undang-undang Bank Indonesia'' (Bank Indonesia Act), ''Undang-undang Informasi dan Transaksi Elektronik'' (Information and Electronic Transaction Act), and ''Undang-undang Mata Uang'' (Monetary Act). For example, ''Undang-undang Mata Uang'' states that ] is the only legal tender in the country. He also strongly advised the public against using bitcoins because security of bitcoins transactions are not guaranteed. However, currently BI does not have detailed policies of regulating or banning bitcoins usage.<ref>{{cite news |title=BI: Pemakaian bitcoin melanggar Undang-undang! (BI: Bitcoin usage violate laws!)|url=http://nasional.kontan.co.id/news/bi-pemakaian-bitcoin-melanggar-undang-undang|date=16 January 2014 |last=Syafina|first=DC|publisher= ]|accessdate=18 January 2014}}</ref> | ||

| On 6 February 2014, ] is stating that Bitcoin and other virtual currencies are not currencies or legal tender in Indonesia. The people are urged to exercise caution towards Bitcoin and other virtual currencies. All risks regarding ownership or use of Bitcoin are borne by the owner or user of Bitcoin and other virtual currencies.<ref>{{cite news |title=Pernyataan Bank Indonesia Terkait Bitcoin dan Virtual Currency Lainnya (Bank Indonesia statement on Bitcoin and other virtual currencies) |url=http://www.bi.go.id/id/ruang-media/siaran-pers/Pages/sp_160614.aspx|date=6 February 2014 |publisher=] |accessdate=7 February 2014}}</ref> | On 6 February 2014, ] is stating that Bitcoin and other virtual currencies are not currencies or legal tender in Indonesia. The people are urged to exercise caution towards Bitcoin and other virtual currencies. All risks regarding ownership or use of Bitcoin are borne by the owner or user of Bitcoin and other virtual currencies.<ref>{{cite news |title=Pernyataan Bank Indonesia Terkait Bitcoin dan Virtual Currency Lainnya (Bank Indonesia statement on Bitcoin and other virtual currencies) |url=http://www.bi.go.id/id/ruang-media/siaran-pers/Pages/sp_160614.aspx|date=6 February 2014 |publisher=] |accessdate=7 February 2014}}</ref> | ||

| Line 85: | Line 105: | ||

| | {{flag|Japan}} || {{yes}} || On 7 March 2014, the Japanese government, in response to a series of questions asked in the National Diet, made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions.<ref>{{ cite news | url=http://www.nikkei.com/article/DGXNASGC0700C_X00C14A3MM0000/ | work=Nikkei Inc. | title= The First Governmental View: Bitcoin is not Currency (in Japanese) | date=7 March 2014 }}</ref> The decision did not see bitcoin as currency nor bond under the current Banking Act and Financial Instruments and Exchange Law, prohibiting banks and securities companies to deal bitcoins. The decision also acknowledges that there is no laws to unconditionally prohibit individuals or legal entities to receive bitcoins in exchange of goods or services. Taxes may be applicable to bitcoins. | | {{flag|Japan}} || {{yes}} || On 7 March 2014, the Japanese government, in response to a series of questions asked in the National Diet, made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions.<ref>{{ cite news | url=http://www.nikkei.com/article/DGXNASGC0700C_X00C14A3MM0000/ | work=Nikkei Inc. | title= The First Governmental View: Bitcoin is not Currency (in Japanese) | date=7 March 2014 }}</ref> The decision did not see bitcoin as currency nor bond under the current Banking Act and Financial Instruments and Exchange Law, prohibiting banks and securities companies to deal bitcoins. The decision also acknowledges that there is no laws to unconditionally prohibit individuals or legal entities to receive bitcoins in exchange of goods or services. Taxes may be applicable to bitcoins. | ||

| |- | |- | ||

| | {{flag|Jordan}} || {{partial|Restricted}} || The Central Bank of Jordan prohibits banks, currency exchanges, financial companies, and payment service companies from dealing in bitcoins or other digital currencies.<ref name=jordantimes/> While it warned the public of risks of bitcoins, and that they are not legal tender, bitcoins are still accepted by small businesses and merchants.<ref name=jordantimes>{{ cite news | url=http://jordantimes.com/central-bank-warns-against-using-bitcoin | work=The Jordan Times | title=Central bank warns against using bitcoin | first=Omar | last=Obeidat | date=22 |

| {{flag|Jordan}} || {{partial|Restricted}} || The Central Bank of Jordan prohibits banks, currency exchanges, financial companies, and payment service companies from dealing in bitcoins or other digital currencies.<ref name=jordantimes/> While it warned the public of risks of bitcoins, and that they are not legal tender, bitcoins are still accepted by small businesses and merchants.<ref name=jordantimes>{{ cite news | url=http://jordantimes.com/central-bank-warns-against-using-bitcoin | work=The Jordan Times | title=Central bank warns against using bitcoin | first=Omar | last=Obeidat | date=22 February 2014 }}</ref> | ||

| |- | |- | ||

| |{{flag|Kyrgyzstan}}||{{no}}|| The Central bank of Kyrgyzstan prohibits bitcoin operations.<ref name=bitcoin_kyrgyzstan>{{cite news| url=http://www.coindesk.com/kyrgyzstan-bitcoin-payments-violate-state-law/| work=CoinDesk|title=Kyrgyzstan Bitcoin Payments Violate State Law| date= 4 August 2014}}</ref> | |{{flag|Kyrgyzstan}}||{{no}}|| The Central bank of Kyrgyzstan prohibits bitcoin operations.<ref name=bitcoin_kyrgyzstan>{{cite news| url=http://www.coindesk.com/kyrgyzstan-bitcoin-payments-violate-state-law/| work=CoinDesk|title=Kyrgyzstan Bitcoin Payments Violate State Law| date= 4 August 2014}}</ref> | ||

| Line 101: | Line 121: | ||

| | {{flag|Poland}} || {{yes}} || Poland made a first official announcement on the legality of Bitcoin on 18 December 2013 stating Bitcoin is "not illegal".<ref name="pil biznesu">{{cite web |title=Bitcoin Is Not Illegal |date=18 December 2013 |accessdate=18 December 2013 |url=http://www.pb.pl/3485125,94998,minfin-bitcoin-nie-jest-nielegalny}}</ref> The announcement was made by Szymon Woźniak of the ] but further also clarified that while not Illegal, bitcoin cannot be considered legal as a form of tender, as yet. | | {{flag|Poland}} || {{yes}} || Poland made a first official announcement on the legality of Bitcoin on 18 December 2013 stating Bitcoin is "not illegal".<ref name="pil biznesu">{{cite web |title=Bitcoin Is Not Illegal |date=18 December 2013 |accessdate=18 December 2013 |url=http://www.pb.pl/3485125,94998,minfin-bitcoin-nie-jest-nielegalny}}</ref> The announcement was made by Szymon Woźniak of the ] but further also clarified that while not Illegal, bitcoin cannot be considered legal as a form of tender, as yet. | ||

| |- | |- | ||

| | {{flag|Russia}} || {{yes}} || On January |

| {{flag|Russia}} || {{yes}} || On 27 January 2014, the Central Bank of the Russian Federation issued a statement entitled "On Using Virtual Currencies, Specifically Bitcoin, in Transactions". According to the statement, the Central Bank views the services of Russian legal entities aimed at assisting in the exchange of bitcoins for goods, services, or currencies as a "dubious activity" associated with money laundering and terrorism financing, and recommends that Russian individuals and legal entities refrain from transactions involving bitcoins.<ref>{{cite news|title=Russia: Bitcoin Exchanges Can Be Penalized|url=http://www.loc.gov/lawweb/servlet/lloc_news?disp3_l205403857_text|accessdate=23 March 2014|newspaper=The Library of Congress|date=2 February 2014}}</ref> In February 2014, Russia's Prosecutor General's Office claimed that Bitcoin is a money substitute and "cannot be used by individuals or legal entities".<ref name="Russian Bitcoin ban">{{cite news|last=Hamburger|first=Ellis|title=Russia bans Bitcoin use|url=http://www.theverge.com/2014/2/9/5395050/russia-bans-bitcoin|accessdate=February 10, 2014|newspaper=The Verge|date=February 9, 2014}}</ref> However, the Central Bank clarified that there are no plans for immediate ban on any cryptocurrencies; the government intents to prevent illegal usage of such currencies, and to develop legal framework protecting citizens and legal entities that use the cryptocurrencies.<ref>{{cite web |title=Центробанк опровергает "запрет Биткойна в России" | language=Russian | date=5 March 2014 |accessdate=10 March 2014 |url=http://bitnovosti.com/2014/03/04/net-zapreta-bitcoina-v-rossii/|publisher=Bit Новости}}</ref> | ||

| |- | |- | ||

| | {{flag|Slovenia}} || {{yes}} || On December 23, 2013 the Slovenian Ministry of Finance made an announcement <ref>{{cite web|url=http://www.durs.gov.si/si/davki_predpisi_in_pojasnila/dohodnina_pojasnila/dohodek_iz_kapitala/dobicek_iz_kapitala/vrednostni_papirji_in_delezi_v_gospodarskih_druzbah_zadrugah_in_drugih_oblikah_organiziranja_ter_investicijski_kuponi/davcna_obravnava_poslovanja_z_virtualno_valuto_po_zdoh_2_in_zddpo_2/ |title=Davčna obravnava poslovanja z virtualno valuto po ZDoh-2 in ZDDPO-2 | Davčna uprava RS | language=Slovenian| publisher=Durs.gov.si |date=2013-12-23 |accessdate=2013-12-27}}</ref> stating that Bitcoin is not a currency nor an Asset. There is no capital gains tax chargeable on Bitcoin however Bitcoin mining is taxed and business selling goods/services in Bitcoin are also taxed. | | {{flag|Slovenia}} || {{yes}} || On December 23, 2013 the Slovenian Ministry of Finance made an announcement <ref>{{cite web|url=http://www.durs.gov.si/si/davki_predpisi_in_pojasnila/dohodnina_pojasnila/dohodek_iz_kapitala/dobicek_iz_kapitala/vrednostni_papirji_in_delezi_v_gospodarskih_druzbah_zadrugah_in_drugih_oblikah_organiziranja_ter_investicijski_kuponi/davcna_obravnava_poslovanja_z_virtualno_valuto_po_zdoh_2_in_zddpo_2/ |title=Davčna obravnava poslovanja z virtualno valuto po ZDoh-2 in ZDDPO-2 | Davčna uprava RS | language=Slovenian| publisher=Durs.gov.si |date=2013-12-23 |accessdate=2013-12-27}}</ref> stating that Bitcoin is not a currency nor an Asset. There is no capital gains tax chargeable on Bitcoin however Bitcoin mining is taxed and business selling goods/services in Bitcoin are also taxed. | ||

| |- | |- | ||

| | {{flag|Singapore}} || {{yes}} || On September 22, 2013, the ] (MAS) warned users of the risks associated with using Bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse"<ref>{{cite web|author=Irene Tham |url=http://business.asiaone.com/news/bitcoin-users-beware-mas |title=Bitcoin users beware: MAS | AsiaOne Business |publisher=Business.asiaone.com |date=2013-09-22 |accessdate=2013-12-27}}</ref> and in December 2013 made a followup statement regarding Bitcoin stating “Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene”<ref>{{cite web|author=December 23, 2013 at 4:31 pm by Terence Lee |url=http://www.techinasia.com/singapore-government-decides-interfere-bitcoin/ |title=Singapore government decides not to interfere with Bitcoin |publisher=Techinasia.com |date=2013-12-23 |accessdate=2013-12-27}}</ref> In January 2014, the ] (IRAS) has issued a series of tax guidelines on Bitcoins. It is stated that bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Businesses that deal with bitcoin currency exchanges will be taxed based on their sales of bitcoins.<ref>{{cite news |title=Singaporean Tax Authorities Have Issued Guidance On Bitcoin-Related Sales And Earnings|url=http://www.businessinsider.com.au/singaporean-tax-authorities-have-issued-guidance-on-bitcoin-related-sales-and-earnings-2014-1 |date=9 January 2014 |last=Tay |first=Liz |publisher=] |accessdate=11 January 2014}}</ref> | | {{flag|Singapore}} || {{yes}} || The ] may require bitcoin intermediaries to collect personal details of their customers and report suspicious activity similar to what it requires from ]s.<ref>{{cite news|title=Singapore acts first to regulate Bitcoin|url=http://www.neurope.eu/article/singapore-acts-first-regulate-bitcoin|accessdate=23 March 2014|newspaper=New Europe|date=23 March 2014}}</ref> | ||

| On September 22, 2013, the ] (MAS) warned users of the risks associated with using Bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse"<ref>{{cite web|author=Irene Tham |url=http://business.asiaone.com/news/bitcoin-users-beware-mas |title=Bitcoin users beware: MAS | AsiaOne Business |publisher=Business.asiaone.com |date=2013-09-22 |accessdate=2013-12-27}}</ref> and in December 2013 made a followup statement regarding Bitcoin stating “Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene”<ref>{{cite web|author=December 23, 2013 at 4:31 pm by Terence Lee |url=http://www.techinasia.com/singapore-government-decides-interfere-bitcoin/ |title=Singapore government decides not to interfere with Bitcoin |publisher=Techinasia.com |date=2013-12-23 |accessdate=2013-12-27}}</ref> In January 2014, the ] (IRAS) has issued a series of tax guidelines on Bitcoins. It is stated that bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Businesses that deal with bitcoin currency exchanges will be taxed based on their sales of bitcoins.<ref>{{cite news |title=Singaporean Tax Authorities Have Issued Guidance On Bitcoin-Related Sales And Earnings|url=http://www.businessinsider.com.au/singaporean-tax-authorities-have-issued-guidance-on-bitcoin-related-sales-and-earnings-2014-1 |date=9 January 2014 |last=Tay |first=Liz |publisher=] |accessdate=11 January 2014}}</ref> | |||

| |- | |- | ||

| | {{flag|South Korea}} || {{yes}} || There are no laws in South Korea regulating the use of Bitcoin at present.<ref name="Congress report">{{cite report |url=http://www.loc.gov/law/help/bitcoin-survey/regulation-of-bitcoin.pdf |title=Regulation of Bitcoin in Selected Jurisdictions |publisher=The Law Library of Congress |date=January, 2014}}</ref> On December 12 2013, the president of the ] recommended at a press conference that Bitcoin be regulated in the future.<ref>{{cite web |url=http://economy.hankooki.com/lpage/economy/201312/e2013122715412370070.htm |title=한은 "정부 비트코인 규제 만들어라" |trans_title=Bank of Korea:"Government Needs to Make Bitcoin | | {{flag|South Korea}} || {{yes}} || There are no laws in South Korea regulating the use of Bitcoin at present.<ref name="Congress report">{{cite report |url=http://www.loc.gov/law/help/bitcoin-survey/regulation-of-bitcoin.pdf |title=Regulation of Bitcoin in Selected Jurisdictions |publisher=The Law Library of Congress |date=January, 2014}}</ref> On December 12 2013, the president of the ] recommended at a press conference that Bitcoin be regulated in the future.<ref>{{cite web |url=http://economy.hankooki.com/lpage/economy/201312/e2013122715412370070.htm |title=한은 "정부 비트코인 규제 만들어라" |trans_title=Bank of Korea:"Government Needs to Make Bitcoin | ||

| Line 118: | Line 139: | ||

| | {{flag|United Kingdom}} || {{yes}} || Bitcoin is treated as 'private money'. When Bitcoin is exchanged for Sterling or for foreign currencies, such as Euros or Dollars, no VAT will be due on the value of the Bitcoins themselves. However, in all instances, VAT will be due in the normal way from suppliers of any goods or services sold in exchange for Bitcoin or other similar cryptocurrency. Profits and losses on cryptocurrencies are subject to ].<ref>{{cite web|title=Tax treatment of activities involving Bitcoin and other similar cryptocurrencies|url=http://www.hmrc.gov.uk/briefs/vat/brief0914.htm|publisher=HM Revenue & Customs}}</ref> | | {{flag|United Kingdom}} || {{yes}} || Bitcoin is treated as 'private money'. When Bitcoin is exchanged for Sterling or for foreign currencies, such as Euros or Dollars, no VAT will be due on the value of the Bitcoins themselves. However, in all instances, VAT will be due in the normal way from suppliers of any goods or services sold in exchange for Bitcoin or other similar cryptocurrency. Profits and losses on cryptocurrencies are subject to ].<ref>{{cite web|title=Tax treatment of activities involving Bitcoin and other similar cryptocurrencies|url=http://www.hmrc.gov.uk/briefs/vat/brief0914.htm|publisher=HM Revenue & Customs}}</ref> | ||

| |- | |- | ||

| | {{flag|United States}} || {{yes}} || In the United States the first step of regulation occurred in July 2011, when the ]'s ] (FinCEN) added "other value that substitutes for currency" to its definition of ]es.<ref name=fedreg>{{cite web | title=Bank Secrecy Act Regulations; Definitions and Other Regulations Relating to Money Services Businesses |url=https://federalregister.gov/a/2011-18309 | publisher=Federal register | accessdate=6 March 2014 | author=Financial Crimes Enforcement Network | page=76 FR 43585 | date=2011-07-21 | quote=31 C.F.R. § 1010.100(ff)(5)(i)(A)}}</ref> In 2013 the Treasury issued new rules regarding virtual currencies,<ref name=FinCEN>{{cite web|url=http://www.fincen.gov/statutes_regs/guidance/html/FIN-2013-G001.html|title=FIN-2013-G001: Application of FinCEN's Regulations to Persons Administering, Exchanging, or Using Virtual Currencies|date=18 March 2013|publisher=Financial Crimes Enforcement Network|page=6|accessdate=4 March 2014}}</ref> whereby exchanges (but not users) are considered money transmitters and must comply with rules to prevent money laundering and terrorist financing.<ref name="ArsFinCEN">{{cite web|last=Lee|first=Timothy|title=US regulator: Bitcoin Exchanges Must Comply With Money Laundering Laws|url=http://arstechnica.com/tech-policy/2013/03/us-regulator-bitcoin-exchanges-must-comply-with-money-laundering-laws/|publisher=Arstechnica|date=20 March 2013|quote=Bitcoin miners must also register if they trade in their earnings for dollars.|deadurl=no}}</ref> Besides obtaining personal details of clients, bitcoin exchanges must verify that their customers are not on the ].<ref>{{cite web|title=Specially Designated Nationals List (SDN)|url=http://www.treasury.gov/resource-center/sanctions/SDN-List/Pages/default.aspx|work=Resource Center|publisher=US Treasury|accessdate=24 March 2014|date=20 March 2014}}</ref> In April 2014, the Treasury confirmed that bitcoin cloud mining<ref>{{cite web|url=http://www.fincen.gov/news_room/rp/rulings/html/FIN-2014-R007.html|title=FIN-2014-R007: Application of Money Services Business regulations to the rental of computer systems for mining virtual currency|date=29 April 2014|publisher=Financial Crimes Enforcement Network|accessdate=10 May 2014}}</ref> and escrow services<ref>{{cite web|url=http://www.fincen.gov/news_room/rp/rulings/html/FIN-2014-R005.html|title= FIN-2014-R005: Whether a Company that Offers Secured Transaction Services to a Buyer and Seller in a Given Sale of Goods or Services is a Money Transmitter.|date=29 April 2014|publisher=Financial Crimes Enforcement Network|accessdate=10 May 2014}}</ref> are not classified as money transmitters.<ref>{{cite web|author=Andrew Moran |url=http://www.coinbuzz.com/2014/05/01/u-s-fincen-confirms-bitcoin-escrow-cloud-mining-money-transmitters/ |title=U.S. FinCEN confirms bitcoin escrow, cloud mining not money transmitters |work=CoinBuzz |date=1 May 2014 |accessdate = 10 May 2014 |deadurl=no}}</ref> | |||

| ⚫ | |||

| The ] reviewed virtual currencies upon the request of the ] and in May 2013 recommended<ref>{{cite web|url=http://www.gao.gov/products/gao-13-516|title=Virtual Economies and currencies: Additional IRS guidance could reduce tax compliance risks|work=GAO Report GAO-13-516|publisher=Report to the Committee on Finance, U.S. Senate|accessdate=6 March 2014|author=US Government Accountability Office|authorlink=Government Accountability Office|date=May 2013}}</ref> that the ] formulate tax guidance for bitcoin businesses. On 25 March 2014, in time for 2013 tax filing, the IRS issued a guidance that virtual currency is treated as property for U.S. federal tax purposes and that "an individual who 'mines' virtual currency as a trade or business subject to self-employment tax".<ref name=IRS>{{cite web|title= IRS Virtual Currency Guidance|url=http://www.irs.gov/pub/irs-drop/n-14-21.pdf|work=Notice 2014-21|publisher=IRS|accessdate=30 March 2014|author=IRS|date=25 March 2014}}</ref> | |||

| The U.S. ] stated in March 2014 it was considering regulation of digital currencies.<ref>{{cite news|title=U.S. swaps watchdog says considering bitcoin regulation|url=http://www.reuters.com/article/2014/03/11/us-bitcoin-regulation-idUSBREA2A1W020140311|accessdate=11 March 2014|newspaper=Reuters.com|date=11 March 2014|first=Douwe|last=Miedema}}</ref> | |||

| In January 2014, the U.S. ] (SEC) was "very focused" on whether bitcoin-denominated stock exchanges were illegal, per its enforcement administrator, and inquired into the gambling site SatoshiDice listing shares on bitcoin exchange MPEx.<ref>{{cite news|last1=Dougherty|first1=Carter|title=Gambling Website’s Bitcoin-Denominated Stock Draws SEC Inquiry|url=http://www.businessweek.com/news/2014-03-19/gambling-website-s-bitcoin-denominated-stock-draws-sec-inquiry|accessdate=13 June 2014|work=Bloomberg BusinessWeek.com|publisher=Bloomberg LP|date=20 March 2014}}</ref> In May it warned investors that "both fraudsters and promoters of high-risk investment schemes may target Bitcoin users".<ref>{{cite web|title=Investor Alert: Bitcoin and Other Virtual Currency-Related Investments|url=http://investor.gov/news-alerts/investor-alerts/investor-alert-bitcoin-other-virtual-currency-related-investments#.U3GCQ61dVD4|work=Investor.gov|publisher=U.S. Securities and Exchange Commission|accessdate=13 May 2014}}</ref> The SEC charged and settled with the former owner of SatoshiDice in June 2014 for selling securities without registering with the SEC.<ref>{{cite web|title=Press Release SEC Charges Bitcoin Entrepreneur With Offering Unregistered Securities|url=http://www.sec.gov/News/PressRelease/Detail/PressRelease/1370541972520#.U5qaD3bb73C|publisher=SEC.gov|accessdate=13 June 2014|date=3 June 2014}}</ref> | |||

| On 8 May 2014, the U.S. ] issued draft guidance to U.S. politicians who want to receive bitcoin donations.<ref name="ADVISORY OPINION 2014-02">{{cite web | url=http://saos.fec.gov/aodocs/2014-02.pdf | title=FEC Advisory Opinion 2014-02 | publisher=Federal Election Commission | date=8 May 2014 | accessdate=8 May 2014 | author=Goodman, Lee E. }}</ref> The Commission declined to declare bitcoins currency, opting to deem them items "of value".<ref>{{cite news |url=https://www.publicintegrity.org/2014/05/08/14739/what-fecs-bitcoin-ruling-means | title=What the FEC's Bitcoin ruling means |date=8 May 2014 |accessdate=8 May 2014 |first=Dave |last=Levinthal |work=Center for Public Integrity}}</ref> | |||

| In May 2014, Brett Stapper, co-founder of Falcon Global Capital, registered to lobby members of Congress and federal agencies on issues related to bitcoin.<ref name="Bitcoin gets a lobbyist">{{cite web | url=http://thehill.com/policy/technology/207085-bitcoin-investors-register-lobbyist?nr_email_referer=1%29 | title=Bitcoin gets a lobbyist | publisher=The Hill | date=23 May 2014 | accessdate=27 May 2014 | author=Hattem, Julian}}</ref> | |||

| {{as of|August 2014}}, there are no final rules at the U.S. state level yet. In March, the ] lead by superintendent ] had officially invited bitcoin exchanges to apply with them,<ref>{{cite web|title=In the Matter of Virtual Currency Exchanges|work=Public Order|url=http://www.dfs.ny.gov/about/po_vc_03112014.pdf|publisher=New York State Department of Financial Services|accessdate=30 March 2014|date=11 March 2014}}</ref> and on 17 July it published draft regulations for virtual currency businesses.<ref name=wsj72014>{{cite news|last1=Vigna|first1=Paul|title=NY Financial Regulator Releases Draft of ‘Bitlicense’ for Bitcoin Businesses|accessdate=19 July 2014|work=WSJ|publisher=Dow Jones & Company|date=17 July 2014}}</ref> Businesses would have to provide transaction receipts, disclosures about risks, policies to handle customer complaints, maintain a cybersecurity program, hire a compliance officer and verify details about their customers to follow anti-money-laundering rules, per FinCEN.<ref name=wsj72014 /> | |||

| In June California Assemblyman ] (D–Sacramento) submitted draft legislation to legalize bitcoin and all other forms of alternative and digital currency.<ref name="BitcoinCalifornia">{{cite web | url=http://www.businessinsider.com/bitcoin-llegal-in-california-2014-6?utm_source=alerts&nr_email_referer=1 | title=Bitcoin Is Actually Illegal In California, But That Could Change Soon | publisher=Business Insider | date=25 June 2014 | accessdate=26 June 2014 | author=Cosco, Joey}}</ref> After the GAO had called for increased oversight of bitcoin, the ] warned consumers of bitcoin being risky.<ref name=CFPB>{{cite news|author1=Peter Schroeder|title=CFPB warns consumers about bitcoin 'Wild West'|url=http://thehill.com/policy/finance/214831-cfpb-warns-consumers-about-bitcoin-wild-west|accessdate=27 August 2014|work=The Hill|publisher=News Communications, Inc.|date=11 August 2014}}</ref> | |||

| ⚫ | On 18 November 2013, the ] held a committee hearing titled ''Beyond Silk Road: Potential Risks, Threats and Promises of Virtual Currencies'' to discuss virtual currencies.<ref name="theguardian">{{cite web |url= http://www.theguardian.com/technology/2013/nov/18/bitcoin-risks-rewards-senate-hearing-virtual-currency |title= Bitcoin hits $700 high as Senate stages hearing on virtual currency |date= 18 November 2013 |accessdate= 24 November 2013 |first= Dominic |last= Rushe |work= The Guardian}}</ref> At this hearing, held by senator ], Bitcoin and other currencies were received generally positively, with it being stated that Bitcoin was a "legal means of exchange" and that "online payment systems, both centralized and decentralized, offer legitimate financial services" by US officials such as Peter Kadzik and ].<ref name="raskin">{{cite web |url= http://www.bloomberg.com/news/2013-11-18/u-s-agencies-to-say-bitcoins-offer-legitimate-benefits.html |title= U.S. Agencies to Say Bitcoins Offer Legitimate Benefits |date= 18 November 2013 |accessdate= 24 November 2013 |first= Max |last= Raskin |work= Bloomberg}}</ref><ref>{{cite web |url= http://www.washingtonpost.com/business/economy/for-bitcoin-a-successful-charm-offensive-on-the-hill/2013/11/22/000ed4b0-53b1-11e3-a7f0-b790929232e1_story.html |title= For Bitcoin, a successful charm offensive on the Hill |date= 23 November 2013 |accessdate= 24 November 2013 |first= Timothy |last= Lee |work= Washington Post}}</ref> It was noted, however, that the Justice Department's Criminal Division has seen an increased use of virtual currencies for illegal purposes such as drugs and child pornography.<ref>{{cite web |url= http://www.bbc.co.uk/news/technology-24986264 |title= 'Legitimate' Bitcoin's value soars after Senate hearing |date= 19 November 2013 |accessdate= 24 November 2013 |work= BBC News}}</ref> | ||

| After the ] recommended that the ] make its position clear on Bitcoin,<ref name="gn18"/> the IRS announced in March 2014 that opted to consider Bitcoin a form of 'property' rather than a currency, meaning that every transaction where Bitcoin is used as payment would be subjected to capital gains tax.<ref>{{cite web|url=http://www.businessweek.com/news/2014-03-26/bitcoin-currency-use-impeded-by-irs-property-treatment-taxes|title=Bitcoin Currency Use Impeded by IRS Property Treatment|publisher=Bloomberg BusinessWeek|date=2014-03-26|accessdate=2014-03-26}}</ref> The IRS also announced that Bitcoin mining activity would be taxed as income on the basis of fair market value as of the date of the specific activity, and that all of the foregoing guidance would be applied retroactively. On the other hand, US Treasury authorities subject Bitcoin to ] regulations, which imposes fairly high regulatory burden on any entity that would envisage, for instance, to operate an ATM for Bitcoin. In March 2013, ] issued an advisory that their rules for combating money laundering and terrorist financing, as well as the state-by-state licensing as money transmitters apply to virtual currency businesses, which must collect and report relevant data.<ref name="gn18">{{cite web|url=http://www.theguardian.com/commentisfree/2013/nov/18/bitcoin-senate-hearings-regulation |title=US regulations are hampering Bitcoin's growth |publisher=Theguardian.com |date=2013-05-17 |accessdate=2013-12-27}}</ref> | After the ] recommended that the ] make its position clear on Bitcoin,<ref name="gn18"/> the IRS announced in March 2014 that opted to consider Bitcoin a form of 'property' rather than a currency, meaning that every transaction where Bitcoin is used as payment would be subjected to capital gains tax.<ref>{{cite web|url=http://www.businessweek.com/news/2014-03-26/bitcoin-currency-use-impeded-by-irs-property-treatment-taxes|title=Bitcoin Currency Use Impeded by IRS Property Treatment|publisher=Bloomberg BusinessWeek|date=2014-03-26|accessdate=2014-03-26}}</ref> The IRS also announced that Bitcoin mining activity would be taxed as income on the basis of fair market value as of the date of the specific activity, and that all of the foregoing guidance would be applied retroactively. On the other hand, US Treasury authorities subject Bitcoin to ] regulations, which imposes fairly high regulatory burden on any entity that would envisage, for instance, to operate an ATM for Bitcoin. In March 2013, ] issued an advisory that their rules for combating money laundering and terrorist financing, as well as the state-by-state licensing as money transmitters apply to virtual currency businesses, which must collect and report relevant data.<ref name="gn18">{{cite web|url=http://www.theguardian.com/commentisfree/2013/nov/18/bitcoin-senate-hearings-regulation |title=US regulations are hampering Bitcoin's growth |publisher=Theguardian.com |date=2013-05-17 |accessdate=2013-12-27}}</ref> | ||

| Line 129: | Line 166: | ||

| ==External links== | ==External links== | ||

| * | * | ||

| * | |||

| * {{cite report |url=http://www.loc.gov/law/help/bitcoin-survey/regulation-of-bitcoin.pdf |title=Regulation of Bitcoin in Selected Jurisdictions |publisher=The Law Library of Congress |date=January, 2014}} | * {{cite report |url=http://www.loc.gov/law/help/bitcoin-survey/regulation-of-bitcoin.pdf |title=Regulation of Bitcoin in Selected Jurisdictions |publisher=The Law Library of Congress |date=January, 2014}} | ||

Revision as of 22:42, 20 October 2014

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages)

|

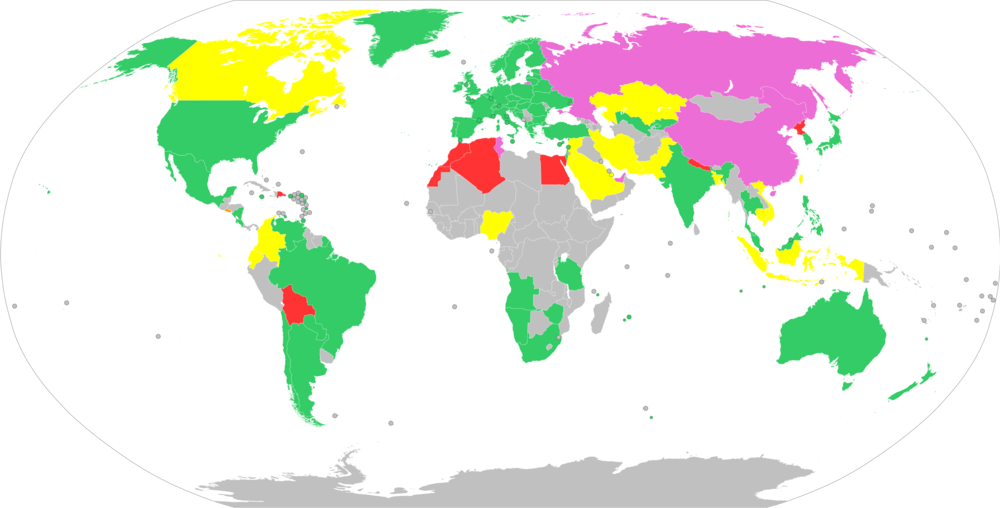

The legal status of cryptographic currencies (in particular, of Bitcoin, the first cryptocurrency) varies substantially from country to country, and is still undefined or changing in many of them. While some countries have explicitly allowed their use and trade, others have banned or severely restricted it. Some countries that allow or tolerate cryptocurrencies have chosen to treat them as foreign currencies, sometimes with status of legal tender; while others have denied their currency status but consider them as a valuable property.

Reasons that have been alleged for restricting or banning cryptocurrencies include their use for illegal trade and other illegal payments, protection of the national currency, and protection of the nation's financial system. Many central banks, even in countries that officially allow their use, have issued warnings to the public about their risks.

International

In July 2014 the European Banking Authority advised European banks not to deal in virtual currencies such as bitcoin until a regulatory regime was in place.

The 2013 G7's Financial Action Task Force published guidance for Internet-based payment services that defines "exchangers buying or selling digital currency for cash (or other digital currencies) as a virtual bureau de change" and warns that "Internet-based payment services that allow third party funding from anonymous sources may face an increased risk of " concluding that this may "pose challenges to countries in regulation and supervision".

List of legal status by country

| Country | Legal? | Notes |

|---|---|---|

| Yes | ||

| Yes | The Australian government has been warm towards Bitcoin. Companies are allowed to trade in Bitcoins, and buying or mining Bitcoins is not considered illegal. The Australian government has released tax guidelines for the country. The Australian Taxation Office (ATO) has announced that it intends to work Bitcoin capital gains and sales tax guidelines into its system for users to declare on tax returns this year. On 9 April 2014, the National Australia Bank (NAB) has decided to dissociate itself from bitcoin, informing bitcoin-related customers it will be closing their accounts next month. In December 2013, the governor of the Reserve Bank of Australia (RBA) indicated in an interview that the bitcoin has not caused RBA any "material problem yet" but that there were risks for speculators. He also mentioned there is no law against holding or transacting in other currencies in Australia, including the bitcoin. | |

| Yes | ||

| No | Bangladesh's central bank on Monday September 15, 2014 warned against dealing in Bitcoin, saying anybody caught using the virtual currency could be jailed under the country's strict anti-money laundering laws. | |

| Yes | The government has decided to take a hands-off approach to the currency. Belgium's finance minister has publicly stated that he sees no problem with the currency and that the national bank would have no objections to it. The country's money laundering agency has also not released any guidelines or warnings against the currency. | |

| No | The Central Bank of Bolivia (BCB for short in Spanish Banco Central de Bolivia) released a resolution stating that cryptocurrency is not allowed in Bolivia. Bitcoin is banned by the Bolivian central bank. | |

| Yes | The Brazilian tax authority followed in the Internal Revenue Service’s footsteps today in requiring bitcoin holders in Brazil to file capital gains on their tax returns. Like the IRS, Brazil is refraining from call it a currency, but instead requires people to file capital gains like any other security. The tax is good on holders of R$1,000 or more in bitcoin, which is around $450. Those who have over R$35,000 in bitcoin accounts pay a 15% capital gain charge as well to the Brazilian government. Gains (and losses) are to be filed annually with tax returns. | |

| Yes | On 2 April 2014, the Bulgarian National Revenue Agency issued a statement concerning the taxing of bitcoin. For the purpose of applying laws governing income taxes bitcoin is considered a financial instrument. The taxable income is determined by the sum of the profits from transactions with bitcoin decreased by the sum ot losses from transactions with bitcoin. The profit or loss from a transaction is calculated based on the comparison between the sale price and the aquistion price of bitcoin. | |

| Yes | The Canadian government announced in February 2014 that it was going to regulate bitcoin under existing anti-money laundering and counter-terrorist financing legislation. In Quebec, The Financial Markets Authority stated in regards to bitcoin ATMs, that it would prosecute any violation of the Securities Act, the Derivatives Act, or the Money Services Business Act.

On 5 November 2013, the Canada Revenue Agency issued a statement clarifying the tax treatment of Bitcoin. The statement is a brief outline which states that tax rules apply when Bitcoin is used to pay for goods and services in the same way the rules apply for barter transactions. In Canada, the federal government announced that it was going to regulate Bitcoin under its anti-money laundering and counter-terrorist financing legislation, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. The Quebec government agency, the Autorité des marches financiers, also announced that it would prosecute violations of the Securities Act (Loi sur les valeurs mobilières), the Derivatives Act (Loi sur les instruments dérivés) and the Money Services Businesses Act (Loi sur les enterprises de services monétaires) for Bitcoin transactions, particularly those involving Bitcoin ATMs. | |

| Restricted (Mainland) |

China restricted bitcoin exchange for local currency in December 2013. On 10 April 2014, the People’s Bank of China ordered banks and all third-party payment services to stop dealing with anyone in the bitcoin business. The ruling de-funds all Chinese bitcoin trading websites, as they will no longer have bank accounts in China.

On 5 December 2013, China Central Bank barred financial institutions from handling Bitcoin transactions, moving to regulate the virtual currency. The People's Bank of China said financial institutions and payment companies can’t give pricing in Bitcoin, buy and sell the virtual currency or insure Bitcoin-linked products, according to a statement on the central bank’s website. On 16 December it was speculated that the People's Bank of China had issued a new ban on third-party payment processors from doing business with Bitcoin exchanges, however a statement from BTC China suggests this isn't accurate, and rather payment processors had voluntarily withdrawn their services. Trading bitcoins by individuals is however legal in China. | |

| Yes | Pre-existing Hong Kong law covers acts of fraud and money laundering involving virtual commodities.

On 16 November 2013, Norman Chan, the chief executive of Hong Kong Monetary Authority (HKMA) said that bitcoins is only a virtual commodity. He also decided that bitcoins will not be regulated by HKMA. However, the authority will be closely watching the usage of bitcoins locally and its development overseas. | |

| Restricted | On 21 November 2013, Perng Fai-nan, the governor of Central Bank of the Republic of China (Taiwan) (CBC) said that the central bank view bitcoins similar to precious metals transactions and has adopted measures to prevent money laundering in bitcoins.

On 6 December 2013, Perng Fai-nan said that Bitcoins is only used in certain communities. Besides, he also opined that the value of Bitcoin is a bubble and is highly volatile. Therefore he advised the public against the speculation of bitcoins to prevent making a loss during the process. The central bank is closely watching the development of Bitcoin and plan to impose regulations in the future. On 31 December 2013, Financial Supervisory Commission (Republic of China) (FSC) and CBC issued a joint statement which warns against the use of bitcoins. It is stated that bitcoins remains highly volatile, highly speculative, vulnerable to cyber attacks, malicious defaults, theft, and is not entitled to legal claims or guarantee of conversion. On 5 January 2014, FSC chairman Tseng Ming-chung stated that FSC will not allow the installation of Bitcoin ATM in Taiwan because bitcoin is not a currency and it should not be accepted by individuals and banks as payment. | |

| Yes | On 26 March 2014, The Superintendencia Financiera de Colombia (SFC), the government body responsible for overseeing financial systems in Colombia, stated that “The Bitcoin is an asset that has no equivalent statutory legal tender in Colombia since it was not recognized as currency in the country”, and made it clear that "supervised (financial) entities are not authorized to guard, invest or mediate these instruments (Bitcoins). Additionally it is for people to know and accept the risks inherent in their operations with ‘virtual currency’ risks". | |

| Yes | On 17 December 2013, Denmark's Financial Supervisory Authority (FSA) has issued a statement that echoes EBA's warning. In addition, FSA says that doing business with Bitcoin does not fall under its regulatory authority and therefore FSA does not currently prevent anyone from opening such businesses. FSA's chief legal adviser says that Denmark might consider amending existing financial legislation to cover virtual currencies. In March 2014, the Danish Tax Board, the nation's top tax authority, declared that personal profits and losses from Bitcoin trading would not be taxed, although Bitcoin trading businesses would be taxed. | |

| No | On 24 July 2014, Ecuador effectively banned bitcoin, along with all other decentralized digital currencies, approving a monetary reform allowing the government to create its own centralized digital currency. This new reform comes as a severe blow to the bitcoin industry in Ecuador, since it demands that they shut down their operations immediately. Those who defy the ban will face prosecution, and all bitcoins circulated and assets in bitcoin trades face confiscation. | |

| Yes | Finland issued a regulatory guide to Bitcoin in September 2013, which imposed capital gains tax on bitcoins, and taxes bitcoins produced by mining as earned income. | |

| Yes | On 19 August 2013, the German Finance Ministry announced that Bitcoin is now essentially a "Unit of account" and can be used for the purpose of tax and trading in the country. It is not classified as a foreign currency or e–money but stands as "private money" which can be used in "multilateral clearing circles", according to the ministry. | |

| No | Due to the capital controls put in place in 2008 to stop money flight on the króna, buying and selling Bitcoin in Iceland, which appears to consider Bitcoin as a foreign currency, is Illegal. The Icelandic Central Bank confirmed that "it is prohibited to engage in foreign exchange trading with the electronic currency Bitcoin, according to the Icelandic Foreign Exchange Act", however commentators suggest bitcoins mined within Iceland could be freely traded. | |

| Restricted | Digital or virtual currencies such as bitcoin have gained widespread acceptance in India despite a natural skepticism to assets not backed by tangible entities such as land. After the Reserve Bank of India warning in December 2013, a number of bitcoin operators shut shop.

The actions of the ED (enforcement directorate) and the I-T (income-tax) department have sent tremors throughout the mainstream bitcoin community in India, if only for the reason that there is still no official regulation on how companies involved in dealing with digital currencies should comply with anti-money laundering and financial transaction laws. In short, the legality of Bitcoin is in doubt in India. The Reserve Bank of India has cautioned users of virtual currencies of various legal risks. Indian law enforcement agency Enforcement Directorate also searched the office and website of a Bitcoin entrepreneur to analyse any possible legal violation. ED believes that Bitcoins money can be used for hawala transactions and funding terror operations. In June 2013, the Reserve Bank of India (RBI) issued a notice acknowledging that virtual currencies posed legal, regulatory and operational challenges. In August 2013, a spokesperson wrote in an email that Bitcoin was under observation. On 24 December 2013, the Reserve Bank of India issued an advisory to the Indian public not to indulge in buying or selling of virtual currencies, including Bitcoins. Following the announcement Bitcoin operators in the country began suspending operations. The first raid in India was undertaken a couple of days later in Ahmedabad by the Enforcement Directorate (ED) on the office of the website, buysellbit.co.in, that provided a platform to trade in this virtual currency. The preliminary investigations found it to be in violation of the Foreign Exchange Management Act (FEMA). On 28 December 2013, the Deputy Governor of the RBI, K. C. Chakrabarty, made a statement that RBI had no plans to regulate Bitcoins. The consolidated legal position in the month of August 2014 is that the legality of Bitcoin is in doubt in India. The Reserve Bank of India has cautioned users of virtual currencies of various legal risks. Indian law enforcement agency Enforcement Directorate also searched the office and website of a Bitcoin entrepreneur to analyse any possible legal violation. ED believes that Bitcoins money can be used for hawala transactions and funding terror operations. | |