| Revision as of 20:01, 23 March 2009 editChildofMidnight (talk | contribs)43,041 edits worth including← Previous edit | Revision as of 21:11, 23 March 2009 edit undoAvraham (talk | contribs)Autopatrolled, Bureaucrats, Administrators49,215 edits Child of midnight, please see the issues of WP:SYNTH and WP:BLP and WP:ORNext edit → | ||

| Line 24: | Line 24: | ||

| ==Personal life== | ==Personal life== | ||

| Born to |

Born to ] parents, Ralph and Sylvia Madoff,<ref></ref><ref></ref> he grew up in the ] neighborhood of the ] borough of ].<ref>Segal, David; and Cowan, Alison Leigh. , '']'', January 14, 2009. Retrieved February 9, 2009.</ref> He graduated from ] in 1956,<ref name="clusterstock">{{cite web|url=http://clusterstock.alleyinsider.com/2008/12/the-education-of-bernie-madoff-far-rockaway-high-school|title=The Education of Bernie Madoff: The High School Years |publisher=Clusterstock|accessdate=2008-12-25|author=John Carney}}</ref> attended the ] for one year, then transferred to and graduated from ] (then Hofstra College) in 1960 with a degree in ].<ref name="FratBro">{{cite news |last =Salkin |first=Allen | title=Bernie Madoff, Frat Brother | work =] |date=2009-01-16 | url=http://www.nytimes.com/2009/01/18/fashion/18madoff.html | accessdate=2009-01-20}}</ref><ref name="drove madoff">{{cite news |url=http://money.cnn.com/2008/12/26/news/companies/understanding_Madoff/?postversion=2008122608|title=What drove Bernie Madoff |publisher=CNN|accessdate=December 26, 2008|last=Chernoff|date=December 26, 2008}}</ref> The following year, he attended ], but did not continue. | ||

| <ref>http://money.cnn.com/2009/01/16/magazines/fortune/madoff_mother.fortune/index.htm</ref> In later years, he gave advice to a young messenger in his son's investment business: | |||

| <blockquote> | |||

| "Never, ever, ever invest on Wall Street. It is run by crooks, and SOBs . I don’t trust them. Put your own money in a savings bank and you control it yourself. A dollar is worth a dollar. Don’t let greed get into your psyche.”<ref>http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article5949961.ece</ref> | |||

| </blockquote> | |||

| He graduated from ] in 1956,<ref name="clusterstock">{{cite web|url=http://clusterstock.alleyinsider.com/2008/12/the-education-of-bernie-madoff-far-rockaway-high-school|title=The Education of Bernie Madoff: The High School Years |publisher=Clusterstock|accessdate=2008-12-25|author=John Carney}}</ref> attended the ] for one year, then transferred to and graduated from ] (then Hofstra College) in 1960 with a degree in ].<ref name="FratBro">{{cite news |last =Salkin |first=Allen | title=Bernie Madoff, Frat Brother | work =] |date=2009-01-16 | url=http://www.nytimes.com/2009/01/18/fashion/18madoff.html | accessdate=2009-01-20}}</ref><ref name="drove madoff">{{cite news |url=http://money.cnn.com/2008/12/26/news/companies/understanding_Madoff/?postversion=2008122608|title=What drove Bernie Madoff |publisher=CNN|accessdate=December 26, 2008|last=Chernoff|date=December 26, 2008}}</ref> The following year, he attended ], but did not continue. | |||

| Madoff is married to his high school sweetheart, Ruth Alpern, who has been involved with the firm and in the Madoff Charitable Foundation.<ref name="lambiet">{{citenews|url=http://www.palmbeachdailynews.com/news/content/news/2008/12/12/ponzi1212.html|title=Bernie Madoff's arrest sent tremors into Palm Beach|work=Palm Beach Daily|date=December 12, 2008|accessdate=December 12, 2008|last=Lambiet}}</ref><ref>{{cite news|url=http://www.nytimes.com/2009/01/15/business/15cook.html|title=A Madoff Cookbook Has a Secret, Too}}</ref> It has been reported that Mrs. Madoff had reconciled the firm's bank accounts.<ref>{{cite web|url=http://online.wsj.com/article/SB123267210646108493.html?mod=googlenews_wsj | title=Probers Work Backward on Madoff}}</ref> They have two sons, Mark, 45 and Andrew, 42.<ref>{{cite news|url=http://www.nytimes.com/2008/12/16/business/16madoff.html?scp=20&sq=&st=nyt|title=Inquiry Finds No Signs Family Aided Madoff|work=]|accessdate=December 20, 2008|date=December 16, 2008}}</ref> Andrew, was diagnosed with ]. Deborah Madoff, Andrew's wife, reportedly filed for divorce the day before the scheme was publicly disclosed.<ref>{{cite web|url=http://www.nypost.com/seven/02022009/gossip/pagesix/im_not_madoff_153188.htm|title=I'M NOT MADOFF|work=The ]|accessdate=February 10, 2009|date=February 2, 2009}}</ref> Mark took his money out of the investment arm to fund a divorce from his first wife in 2000 and both sons used outside investment firms to run their own private philanthropic foundations, but Andrew had millions invested with his father.<ref name="independent1"></ref> | Madoff is married to his high school sweetheart, Ruth Alpern, who has been involved with the firm and in the Madoff Charitable Foundation.<ref name="lambiet">{{citenews|url=http://www.palmbeachdailynews.com/news/content/news/2008/12/12/ponzi1212.html|title=Bernie Madoff's arrest sent tremors into Palm Beach|work=Palm Beach Daily|date=December 12, 2008|accessdate=December 12, 2008|last=Lambiet}}</ref><ref>{{cite news|url=http://www.nytimes.com/2009/01/15/business/15cook.html|title=A Madoff Cookbook Has a Secret, Too}}</ref> It has been reported that Mrs. Madoff had reconciled the firm's bank accounts.<ref>{{cite web|url=http://online.wsj.com/article/SB123267210646108493.html?mod=googlenews_wsj | title=Probers Work Backward on Madoff}}</ref> They have two sons, Mark, 45 and Andrew, 42.<ref>{{cite news|url=http://www.nytimes.com/2008/12/16/business/16madoff.html?scp=20&sq=&st=nyt|title=Inquiry Finds No Signs Family Aided Madoff|work=]|accessdate=December 20, 2008|date=December 16, 2008}}</ref> Andrew, was diagnosed with ]. Deborah Madoff, Andrew's wife, reportedly filed for divorce the day before the scheme was publicly disclosed.<ref>{{cite web|url=http://www.nypost.com/seven/02022009/gossip/pagesix/im_not_madoff_153188.htm|title=I'M NOT MADOFF|work=The ]|accessdate=February 10, 2009|date=February 2, 2009}}</ref> Mark took his money out of the investment arm to fund a divorce from his first wife in 2000 and both sons used outside investment firms to run their own private philanthropic foundations, but Andrew had millions invested with his father.<ref name="independent1"></ref> | ||

Revision as of 21:11, 23 March 2009

- For the related scandal, see Madoff investment scandal

| Bernard L. Madoff | |

|---|---|

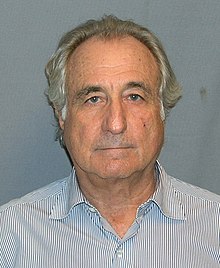

Bernard Madoff's mug shot Bernard Madoff's mug shot | |

| Status | Inmate #61727-054 at the Metropolitan Correctional Center, New York City, NY. |

| Nationality | American |

| Education | Hofstra University (1960) |

| Occupation(s) | Stock broker, financial adviser (retired), former chairman of NASDAQ |

| Employer | Bernard L. Madoff Investment Securities |

| Known for | Ponzi scheme, Chairman of NASDAQ (prior) |

| Spouse | Ruth Alpern Madoff |

| Children | Mark Madoff (ca. 1964), Andrew Madoff (ca. 1966) |

| Criminal charge | Securities fraud, investment advisor fraud, mail fraud, wire fraud, money laundering, false statements, perjury, making false filings with the SEC, theft from an employee benefit plan |

| Penalty | Sentencing scheduled for June 16, 2009; maximum sentence of 150 years in prison and $170 billion in restitution |

Bernard Lawrence "Bernie" Madoff (Template:IPA-en) (born April 29, 1938, in New York City) is a former American businessman and former chairman of the NASDAQ stock exchange, who confessed to, and was convicted of, operating a Ponzi scheme that has been called the largest investor fraud ever committed by a single person.

Personal life

Born to Jewish parents, Ralph and Sylvia Madoff, he grew up in the Laurelton neighborhood of the New York City borough of Queens. He graduated from Far Rockaway High School in 1956, attended the University of Alabama for one year, then transferred to and graduated from Hofstra University (then Hofstra College) in 1960 with a degree in political science. The following year, he attended Brooklyn Law School, but did not continue.

Madoff is married to his high school sweetheart, Ruth Alpern, who has been involved with the firm and in the Madoff Charitable Foundation. It has been reported that Mrs. Madoff had reconciled the firm's bank accounts. They have two sons, Mark, 45 and Andrew, 42. Andrew, was diagnosed with lymphoma. Deborah Madoff, Andrew's wife, reportedly filed for divorce the day before the scheme was publicly disclosed. Mark took his money out of the investment arm to fund a divorce from his first wife in 2000 and both sons used outside investment firms to run their own private philanthropic foundations, but Andrew had millions invested with his father.

Several family members worked for him. His younger brother, Peter, was Senior Managing Director and Chief Compliance Officer, and Peter's daughter, Shana, was the compliance attorney. Madoff’s sons, Mark and Andrew, worked in the trading section, along with Charles Weiner, Madoff’s nephew. Andrew Madoff had invested his own money in his father's fund, but Mark stopped in about 2001.

Madoff lived in Roslyn, New York, in a ranch house through the 1970s and since 1981, has owned an ocean-front residence in Montauk. His primary residence was on Manhattan's Upper East Side, and he was listed as chairman of the building's co-op board. He also owns a home in France and a mansion in Palm Beach, Florida, where he is a member of the Palm Beach Country Club. Madoff owns a 55-foot (17 m) fishing boat named Bull, which is docked in the French Riviera.

According to a March 13, 2009 filing by Madoff, he and his wife were worth up to $126 million, plus an estimated $700 million for the value of his business interest in Bernard L. Madoff Investment Securities LLC. Other major assets include securities ($45 million), cash ($17 million), half-interest in BLM Air Charter ($12 million), 2006 Leopard yacht in France ($7 million), jewelry ($2.6 million), Manhattan apartment ($7 million), Montauk home ($3 million), Palm Beach home ($11 million), Cap d' Antibe, France property ($1 million), and furniture, household goods, and art ($9.9 million).

Madoff was a philanthropist who served on boards of nonprofit institutions, many of which entrusted his firm with their endowments. He is a former National Treasurer of the American Jewish Congress. The collapse and freeze of his personal assets and that of his firm's have had repercussions on businesses, charities and foundations around-the-world, including the Robert I. Lappin Charitable Foundation, the Picower Foundation, and the JEHT Foundation which were forced to close as a consequence.

Madoff donated approximately $6 million to lymphoma research after his son Andrew was diagnosed.

Madoff served as the Chairman of the Board of Directors of the Sy Syms School of Business at Yeshiva University, and as Treasurer of its Board of Trustees. He resigned his position at Yeshiva University after his arrest. Madoff also served on the Board of New York City Center, a member of New York City's Cultural Institutions Group (CIG). He served on the executive council of the Wall Street division of the UJA Foundation of New York, a Jewish foundation which declined to invest funds with him due to the conflict of interest.

Madoff undertook charity work for the Gift of Life Bone Marrow Foundation and also engaged in philanthropic giving through The Madoff Family Foundation, a $19 million private foundation, which he managed along with his wife. They donated money to hospitals and theaters. The foundation has also contributed to many educational, cultural, and health charities, including those later forced to close due to Madoff's fraud. After Madoff's arrest, the assets of the Madoff Family Foundation have been frozen by a federal court.

Madoff was a donor to the Democratic Party and the Republican Party.

Early career

Madoff founded the Wall Street firm Bernard L. Madoff Investment Securities LLC in 1960, and was its chairman until his arrest on December 11, 2008. The firm started as a penny stock trader with $5,000 (about $35,000 in 2008 dollars) that Madoff earned from working as a lifeguard and sprinkler installer. His business grew with the assistance of his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families. Initially, the firm made markets (quoted bid and ask prices) via the National Quotation Bureau's Pink Sheets. In order to compete with firms that were members of the New York Stock Exchange trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes. After a trial run, the technology that the firm helped develop became the NASDAQ.

The firm functioned as a third-market provider, which bypassed exchange specialist firms, by directly executing orders over the counter from retail brokers.At one point, Madoff Securities was the largest market maker at the NASDAQ and in 2008 was the sixth largest market maker on Wall Street The firm also had an investment management and advisory division that was the focus of the fraud investigation.

Madoff was "the first prominent practitioner" who paid a broker to execute a customer's order through his brokerage, called a "legal kickback." Academics have questioned the ethics of these payments. Madoff has argued that these payments did not alter the price that the customer received. He viewed the payments as a normal business practice: "If your girlfriend goes to buy stockings at a supermarket, the racks that display those stockings are usually paid for by the company that manufactured the stockings. Order flow is an issue that attracted a lot of attention but is grossly overrated."

Madoff was active in the National Association of Securities Dealers (NASD), a self-regulatory securities industry organization and has served as the Chairman of the Board of Directors and on the Board of Governors of the NASD.

Access to Washington

The Madoff family gained unusual access to Washington's lawmakers and regulators through the industry's top trade group. The Madoff family has long-standing, high-level ties to the Securities Industry and Financial Markets Association (SIFMA), the primary securities industry organization. Bernard Madoff sat on the Board of Directors of the Securities Industry Association, which merged with the Bond Market Association in 2006 to form SIFMA.

Madoff's brother Peter then served two terms as a member of SIFMA’s Board of Directors. He stepped down from the Board of Directors of the Securities Industry and Financial Markets Association (SIFMA) in December 2008, as news of the Ponzi scheme broke. Peter's resignation came amid growing criticism of the Madoff firm’s links to Washington, and how those relationships may have contributed to the Madoff fraud. Over the years 2000-08, the two Madoff brothers gave $56,000 to SIFMA, and tens of thousands of dollars more to sponsor SIFMA industry meetings.

In addition, Bernard Madoff's niece Shana Madoff was active on the Executive Committee of SIFMA's Compliance & Legal Division, but resigned her SIFMA position shortly after her uncle's arrest. She married an SEC compliance official, Eric Swanson, after an SEC investigation concluded in 2005. A spokesman for Swanson, who has left the SEC, said he "did not participate in any inquiry of Bernard Madoff Securities or its affiliates while involved in a relationship" with Shana Madoff.

Madoff investment scandal

Main article: Madoff investment scandalOn December 10, 2008, Madoff informed his sons that he decided to pay several million dollars in bonuses two months earlier than scheduled. According to federal investigators, Mark and Andrew demanded to know how their father could pay bonuses if he couldn't afford to pay investors. Madoff then admitted the asset management arm of his firm was an elaborate Ponzi scheme. Through their attorney, Madoff's sons reported their father to federal authorities. On December 11, he was arrested and charged with securities fraud.

In February, 2009, Madoff reached an agreement with the SEC, banning him from the securities industry for life. About 120 class action suits have been filed against him.

On March 12, 2009, Madoff pled guilty to 11 felonies, including securities fraud, wire fraud, mail fraud, money laundering, perjury and making false filings with the SEC. The plea came in response to a criminal complaint filed two days earlier, which stated Madoff had defrauded his clients of almost $65 billion. The complaint outlined the largest Ponzi scheme in history, as well as the largest investor fraud committed by a single person. Despite the scale of the fraud, Madoff insists that he was solely responsible for the Ponzi scheme. Madoff did not reach a plea bargain with the government, opting instead to simply plead guilty to all charges. It has been reported that he did so because he refused to cooperate and name any accomplices. He faces a maximum sentence of 150 years in prison, plus mandatory restitution of up to twice the gross gain or loss from his crimes. If the government's estimate of $65 billion is correct, Madoff faces a maximum of $170 billion in restitution.

His pleading allocution, which Madoff read in a "speechlike" statement, summarized that had begun his Ponzi scheme sometime in the early 1990s. He wanted to continue to satisfy the expectations of high returns promised to his clients, in spite of an economic recession. He admitted that he had never invested any of his clients' money since the inception of his scheme. Instead, he simply deposited the money into his business account at Chase Manhattan Bank. He admitted to false trading activities masked by foreign transfers and false SEC returns. He used the Chase business account to pay clients who requested withdrawals, claiming the "profits" were the result of his own unique "split-strike conversion strategy". He declared that he had every intention of resuming legitimate activities in his asset management division, but it proved "difficult, and ultimately impossible" to catch up to the paper profits. Madoff admitted he knew his day of reckoning was inevitable.

According to the original federal complaint, Madoff claimed his firm had "liabilities of approximately US$50 billion." Prosecutors increased their estimate of the size of the fraud from $50 billion to $64.8 billion, based on the amounts in the accounts of Madoff's 4,800 clients in November 30, 2008. On December 10, 2008, he confessed to his sons that the asset management arm of his firm was a giant Ponzi scheme — as he put it, "one big lie." They then passed this information to authorities. The following day, Federal Bureau of Investigation agents arrested Madoff and charged him with one count of securities fraud. Five days after his arrest, Madoff's assets and those of the firm were frozen, and a receiver was appointed to handle the case. Madoff's accountant, David G. Friehling, has been arrested in the case, and law enforcement continues to investigate if others were involved. The SEC conducted several investigations into Madoff's business practices since 1999, which critics contend were incompetently handled.

Concerns about Madoff's business had surfaced as early as 1999, when financial analyst-whistleblower Harry Markopolos informed the SEC that he felt it was legally and mathematically impossible to achieve the gains Madoff claimed to deliver. Others felt it was inconceivable that his growing volume of accounts could be competently serviced by his documented accounting/auditing firm, a three-person firm with only one active accountant.

Madoff had been under 24-hour monitoring and house arrest in his Upper East Side penthouse apartment since December, 2008. However, after accepting Madoff's plea, Judge Denny Chin immediately revoked his $10 million bail and remanded him to the Metropolitan Correctional Center pending sentencing. Chin declared that because of Madoff's age, wealth, and sentencing prospects, he is considered a flight risk.

Madoff's lawyers filed an appeal, and prosecutors responded with a notice of opposition. On March 20,2009, an appellate court denied Madoff's request to be released from jail and returned to "penthouse" home confinement until his June sentencing. Prosecutors have filed two asset forfeiture pleadings which include lists of valuable real and personal property as well as financial interests and entitities.

Some involved in the case as well as other unrelated observers have opined that the actual loss to investors could be far less than reported. Former SEC Chairman Harvey Pitt estimated the actual net fraud to be between $10 and $17 billion, because it does not include the fictional returns credited to the Madoff's customer accounts.

The SEC came under fire for not investigating Madoff sooner, despite complaints from Markopolos and others. In testimony before Congress after the scandal broke, Markopolos claimed it was very easy to prove mathematically that Madoff was running a scam. He said it took him five minutes to make an initial assessment of the fraudulent nature of Madoff's purported high investment returns and about four hours to work the detailed math calculations.

References

- "Bernie Madoff's New Digs: From Penthouse To Outhouse". CNBC. 2009-03-13. Retrieved 2009-03-13.

- ^ "Plea Allocution of Bernard Madoff (U.S. v. Bernard Madoff)". FindLaw. 2009-03-12. Retrieved 2009-03-12.

- In Madoff Scandal, Jews Feel an Acute Betrayal - NYTimes.com

- Madoff Wall Street fraud threatens Jewish philanthropy - Haaretz - Israel News

- Segal, David; and Cowan, Alison Leigh. "Madoffs Shared Much; Question Is How Much", The New York Times, January 14, 2009. Retrieved February 9, 2009.

- John Carney. "The Education of Bernie Madoff: The High School Years". Clusterstock. Retrieved 2008-12-25.

- Salkin, Allen (2009-01-16). "Bernie Madoff, Frat Brother". New York Times. Retrieved 2009-01-20.

- ^ Chernoff (December 26, 2008). "What drove Bernie Madoff". CNN. Retrieved December 26, 2008.

- Lambiet (December 12, 2008). "Bernie Madoff's arrest sent tremors into Palm Beach". Palm Beach Daily. Retrieved December 12, 2008.

- "A Madoff Cookbook Has a Secret, Too".

- "Probers Work Backward on Madoff".

- "Inquiry Finds No Signs Family Aided Madoff". The New York Times. December 16, 2008. Retrieved December 20, 2008.

- "I'M NOT MADOFF". The New York Post. February 2, 2009. Retrieved February 10, 2009.

- ^ The Madoff files: Bernie's billions - Business Analysis & Features, Business - The Independent

- ^ de la Merced, Michael J. (2008-12-24). "Effort Under Way to Sell Madoff Unit". The New York Times. Retrieved 2008-12-24.

- ^ "Standing Accused: A Pillar of Finance and Charity". The New York Times. December 13, 2008.

- Probe Eyes Role of Aide to Madoff, Accountant. Wall Street Journal, December 23, 2008.

- Maier, Kate (December 12, 2008). "Montauk Oceanfront Owner Cited in Ponzi Scheme". East Hampton Star. Retrieved December 23, 2008.

- Jagger, Suzy (December 18, 2008). "Bernard Madoff: the 'most hated man in New York' seeks $3 m for bail". The Times. Retrieved December 23, 2008.

- ^ Frank, Robert (December 13, 2008). "Fund Fraud Hits Big Names; Madoff's Clients Included Mets Owner, GMAC Chairman, Country-Club Recruits". Wall Street Journal. Retrieved December 13, 2008.

{{cite web}}: Unknown parameter|coauthor=ignored (|author=suggested) (help) - "Wall Street Titan May Have Fooled Investors for Years". CNBC. Retrieved December 13, 2008.

- "Madoff's arrest in billion-dollar fraud case shocks Palm Beach investors" Palm Beach Post December 12, 2008.

- Creswell, Julie (January 24, 2009). "The Talented Mr. Madoff". The New York Times. Retrieved January 25, 2009.

- http://www.nypost.com/seven/03132009/news/regionalnews/031309madofffinance.pdf

- "Madoff to appeal bail, net worth revealed". Reuters. March 13, 2009. Retrieved March 13, 2009.

- ^ Appelbaum, Binyamin (December 13, 2008). "'All Just One Big Lie'". The Washington Post. Washington Post Company. p. D01. Retrieved December 12, 2008.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ "Madoff Wall Street fraud threatens Jewish philanthropy". Retrieved December 13, 2008.

- Henriques. "For Investors, Trust Lost, and Money Too". The New York Times. Retrieved December 13, 2008.

- Friedman. "Charity Caught Up in Wall Street Ponzi Scandal". Fox News. Retrieved December 13, 2008.

- NYCC Board of directors New York City Center.

- Moore. "Deal Journal Q&A: A Jewish Charity That Avoided Madoff". The Wall Street Journal. Retrieved December 24, 2008.

- Sherwell. "Bernie Madoff: Profile of a Wall Street star". Telegraph. Retrieved December 14, 2008.

- "The Madoff Case: A Timeline". The Wall Street Journal. March 6, 2009. Retrieved March 6, 2009.

- David Glovin (2009-02-11). "Madoff Prosecutors Get 30 More Days for Indictment". Bloomberg L.P. Retrieved 2009-02-11.

- Glovin, Dan (December 11, 2008). "Madoff Charged in $50 Billion Fraud at Investment Advisory Firm". Bloomberg News. Retrieved December 11, 2008.

{{cite news}}: Unknown parameter|coauthor=ignored (|author=suggested) (help) - Madoff's tactics date to 1960s, when father-in-law was recruiter | Business Features | Jerusalem Post

- Weiner, Eric J. (2005). What Goes Up: The Uncensored History of Modern Wall Street as Told by the Bankers, Brokers, CEOs, and Scoundrels who Made it Happen. Little, Brown and Company. pp. 188–192. ISBN 0316929662.

- ^ O'Hara, Maureen (1995). Market Microstructure Theory. Oxford: Blackwell. p. 190. ISBN 1-55786-443-8. Retrieved December 16, 2008.

- ^ Lieberman, David (December 15, 2008). "Investors remain amazed over Madoff's sudden downfall". USA Today. Retrieved December 24, 2008.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ "SEC Charges Bernard L. Madoff for Multi-Billion Dollar Ponzi Scheme (2008-293)". SEC.gov. U.S. Securities and Exchange Commission. December 11, 2008. Retrieved December 11, 2008.

- Wilhelm, William J. (2001). Information Markets: What Businesses Can Learn from Financial Innovation. Harvard Business Press. p. 153. ISBN 1578512786. Retrieved 2009-03-13.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Princeton University Undergraduate Task Force (2005). "THE REGULATION OF PUBLICLY TRADED SECURITIES" (PDF). U.S. Securities and Exchange Commission. p. 58. Retrieved December 17, 2008.

{{cite web}}: Unknown parameter|month=ignored (help) - Harris, Larry (2003). Trading and Exchanges: Market Microstructure for Practitioners. Oxford University Press. p. 290. ISBN 0195144708. Retrieved 2009-03-13.

- Ferrell, Allen (2001). "A Proposal for Solving the "Payment for Order Flow" Problem" (PDF). 74 S.Cal.L.Rev. 1027. Harvard. Retrieved December 12, 2008.

- Battalio, Robert H. (January 15, 2007). "Does Payment for Order Flow to Your Broker Help or Hurt You?" (PDF). Notre Dame University. Retrieved December 12, 2008.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ McMillan, Alex (May 29, 2000). ""Q&A: Madoff Talks Trading". CNN. Retrieved December 11, 2008.

- "The Owner's Name is on the Door". Madoff.com. Retrieved 2008-12-11. now archived, formerly at www.madoff.com/dis/display.asp?id=203&mode=1&home=1#owner]

- Diana Henriques (2009-01-13). "New Description of Timing on Madoff's Confession". New York Times. Retrieved 2009-01-19.

{{cite news}}: Check date values in:|date=(help) - ^ Barlyn, Suzanne (2008-12-23). "Madoff Case Raises Compliance Questions". Wall Street Journal. Retrieved 2008-03-01.

- Williamson, Elizabeth (2008-12-18). "Family Filled Posts at Industry Groups". Wall Street Journal. Retrieved 2009-03-01.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Lerer, Lisa (2008-12-18). "Peter Madoff resigns". Politico. Retrieved 2009-03-01.

- Williamson, Elizabeth (2008-12-22). "Shana Madoff's Ties to Uncle Probed". Wall Street Journal. Retrieved 2009-03-01.

- Javers, Eamon (2008-12-16). "Madoff bought influence in Washington". Politico. Retrieved 2009-03-01.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Wenzel, Robert (2008-12-22). "Madoff Family Members Had Exclusive Briefings from [[Treasury Secretary]] Paulson on the Financial Crisis". EconomicPolicyJournal.com. Retrieved 2009-03-01.

{{cite web}}: Check|authorlink=value (help); External link in|authorlink= - Madoff, Shana. "San Francisco Topical Breakfast". Compliance and Legal Division of the Securities Industry and Financial Markets Association. Retrieved 2009-03-01.

- Labaton, Stephen (December 16, 2008). "Unlikely Player Pulled Into Madoff Swirl". New York Times.

- Ross, Bryan and Rhee, Joseph (December 16, 2008

publisher=ABC News). "SEC Official Married into Madoff Family".

{{cite news}}: Check date values in:|date=(help); Missing pipe in:|date=(help); line feed character in|date=at position 18 (help)CS1 maint: multiple names: authors list (link) - http://www.usatoday.com/money/markets/2008-12-14-ponzi-madoff-downfall_N.htm

- http://www.washingtonpost.com/wp-dyn/content/article/2008/12/12/AR2008121203970.html

- http://blogs.wsj.com/law/2009/02/09/madoff-makes-peace-with-the-sec-amount-of-fine-tbd/

- ^ USDOJ announcement of Madoff guilty plea

- Bray, Chad (March 12, 2009). "Madoff Pleads Guilty to Massive Fraud". The Wall Street Journal. Dow Jones, Inc. Retrieved March 12, 2009.

- "Wall Street legend Bernard Madoff arrested over '$50 billion Ponzi scheme'". Times Online. Times Newspapers Ltd. December 12, 2008. Retrieved December 13, 2008.

- "Bernard Madoff Will Plead Guilty to 11 Charges in Financial Fraud Case, Faces 150 Years in Prison". Fox News. March 10, 2009. Retrieved March 10, 2009.

- Glovin, David (March 10, 2009). "Madoff to Plead Guilty in Largest U.S. Ponzi Scheme". Bloomberg.com. Retrieved March 10, 2009.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Transcript of Madoff guilty plea hearing

- ^ "SEC: Complaint SEC against Madoff and BMIS LLC" (PDF). U.S. Securities and Exchange Commission. December 11, 2008. Retrieved December 29, 2008.

- Reuters: US Prosecutors updated the size of Madoff's scheme from $50 billion to $64 billion.

- David Voreacos and David Glovin (2008-12-13). "Madoff Confessed $50 Billion Fraud Before FBI Arrest". Bloomberg News.

{{cite news}}: Check date values in:|date=(help) - Binyamin Appelbaum, David S. Hilzenrath and Amit R. Paley (2008-12-13). "It was all one big lie". Washington Post. p. D01. Retrieved 2009-01-18.

{{cite news}}: Check date values in:|date=(help) - Larson. "U.S. Judge Freezes Madoff Assets, Appoints Receiver, SEC Says". Bloomberg.com. Bloomberg News.

- http://dealbook.blogs.nytimes.com/2009/03/13/lawyers-appeal-decision-to-jail-madoff/

- http://www.usdoj.gov/usao/nys/madoff/madoffbailpendingsentencing.pdf

- http://www.bloomberg.com/apps/news?pid=20601103&sid=aUhqoVZyCMRY&refer=us

- http://news.yahoo.com/s/nm/20090320/ts_nm/us_madoff_bail;_ylt=A0wNcwzguMNJgBMANARZ.3QA Retrieved on 2009-03-20.

- http://www.usdoj.gov/usao/nys/madoff/madoffbailpendingsentencing.pdf

- Hays, Tom (March 6, 2009). "Extent of Madoff fraud now estimated at far below $50b". Haaretz. Associated Press. Retrieved March 7, 2009.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - House Committee Finantial Services, Investigations of Madoff Fraud Allegations, Part 1 http://www.c-spanarchives.org/library/index.php?main_page=product_video_info&products_id=283836-1&showVid=true

External links

- Criminal complaint, transcripts of hearings and other documents from the United States Department of Justice

- Bernard L. Madoff Investment Securities This page is now the website for the SIPC receiver of Bernard L. Madoff Investment Securities. (Archive of the pre-receivership website)

- "The Owner's Name is on the Door". Archived from the original on 2008-12-14.

- SEC civil complaint

- SEC press release and update for investors

- Jewish charities hit by Madoff scandal BBC

- Continuously updated table of Madoff's clients from The New York Times

- Madoff Scandal ongoing coverage from the Financial Times

- Madoff Plea Avoids Cooperation Terms - Its Implications with a table of Key Documents: United States v. Madoff from the Federal Evidence Blog

| Scams and confidence tricks | |

|---|---|

| Terminology | |

| Variants |

|

| Internet scams and countermeasures |

|

| Pyramid and Ponzi schemes |

|

| Lists | |

{{subst:#if:Madoff, Bernard L.|}} [[Category:{{subst:#switch:{{subst:uc:1938}}

|| UNKNOWN | MISSING = Year of birth missing {{subst:#switch:{{subst:uc:LIVING}}||LIVING=(living people)}}

| #default = 1938 births

}}]] {{subst:#switch:{{subst:uc:LIVING}}

|| LIVING = | MISSING = | UNKNOWN = | #default =

}}

Categories:- Living people

- LIVING deaths

- 2008 in economics

- American fraudsters

- American Jews

- American money managers

- American money launderers

- American perjurors

- American philanthropists

- American prisoners and detainees

- American white-collar criminals

- Confidence tricksters

- Hedge fund managers

- Hofstra University alumni

- Jewish philanthropists

- People from Manhattan

- People from Queens

- Prisoners and detainees of the United States federal government

- Pyramid and Ponzi schemes